Revised: 07/01/2023

Purchase order (PO) Vouchers must be created when funds are encumbered for the purchase or when the invoice total is over $5,000.

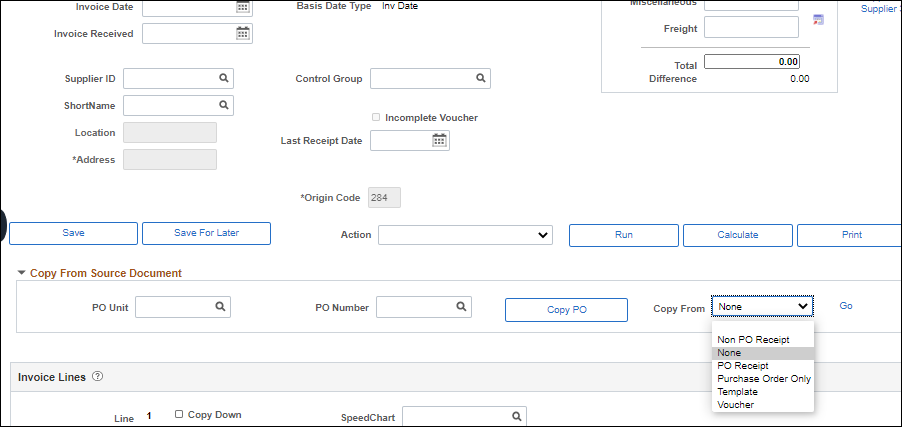

The entry for a PO Voucher is similar to a non-PO voucher, except that the invoice lines (item, description, quantity, etc.) can be pulled from the purchase order systematically. OAKS FIN provides the capability to create a voucher by copying information from a purchase order that already exists in OAKS FIN. Copying from the PO saves time and reduces the possibility of voucher data entry errors. Copying PO information onto the voucher also allows OAKS FIN to perform an automated matching process, which ensures that the State only pays for goods/services that were ordered.

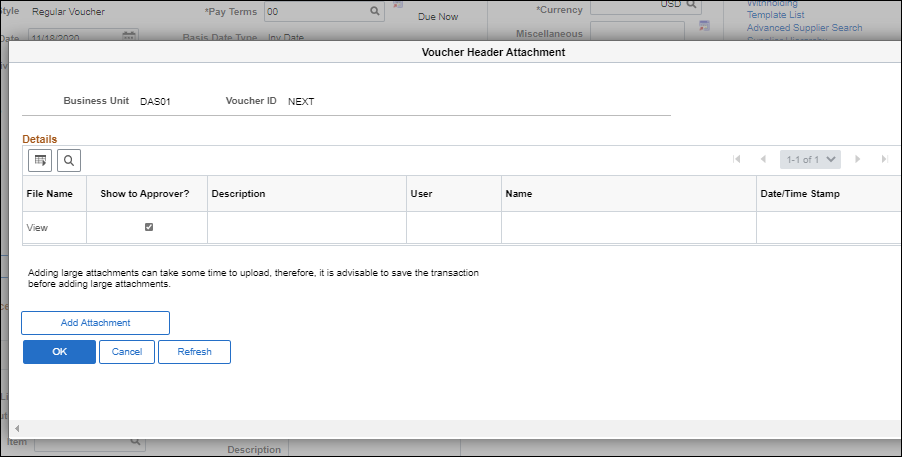

Some vouchers may require central approval, which includes a requirement for supporting documentation.

It is the agency‘s responsibility to make sure prompt payment does not begin until the agency receives a proper invoice. If the agency receives a defective or improper invoice from a payee, there are certain responsibilities and actions to take upon receiving a defective or improper invoice.

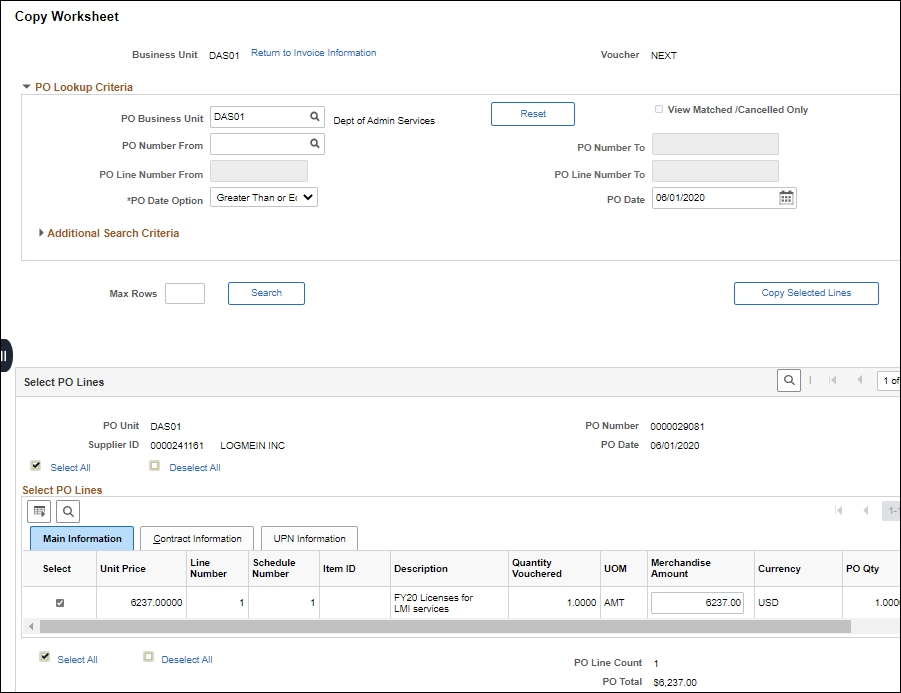

The Copy Worksheet page displays.

Exclude late payment fees (unless the payee and service is a utility regulated by the PUCO.

Exclude past charges.

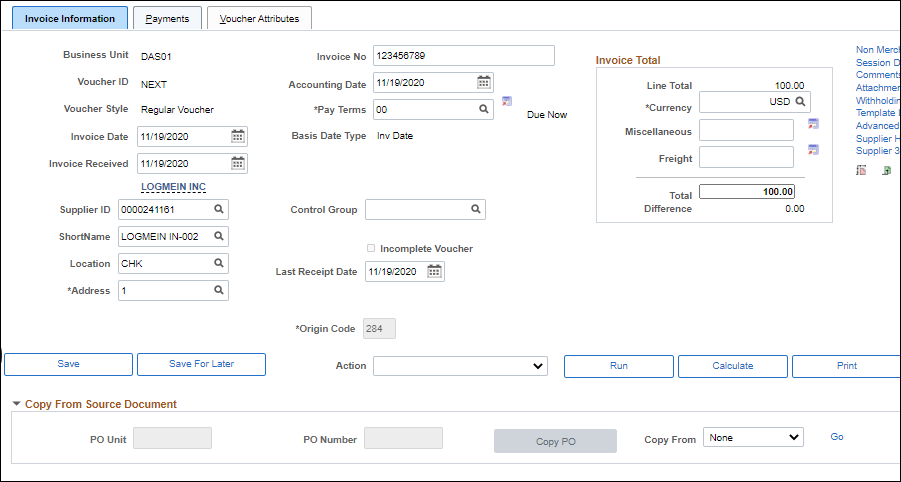

The Invoice Total amount is populated based on the unliquidated amount remaining on the PO. The amount in the Invoice Total field should equal the invoice amount; update this field if necessary.

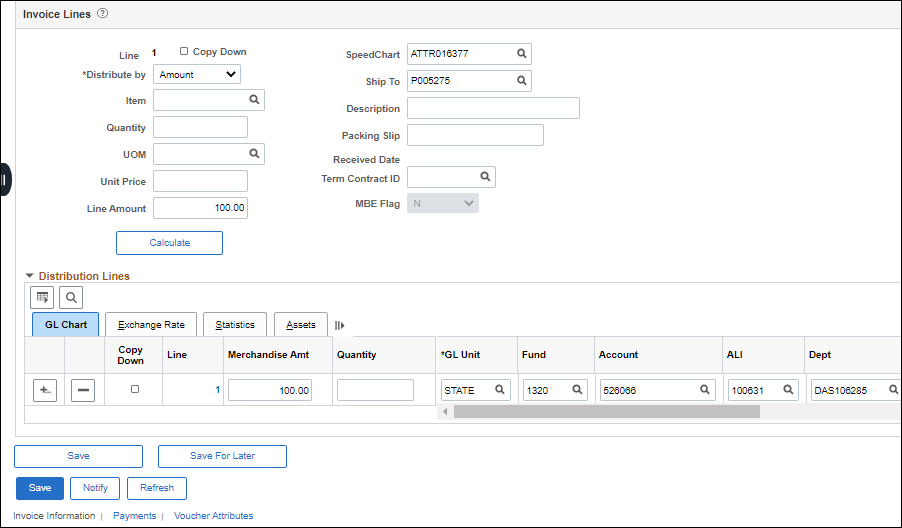

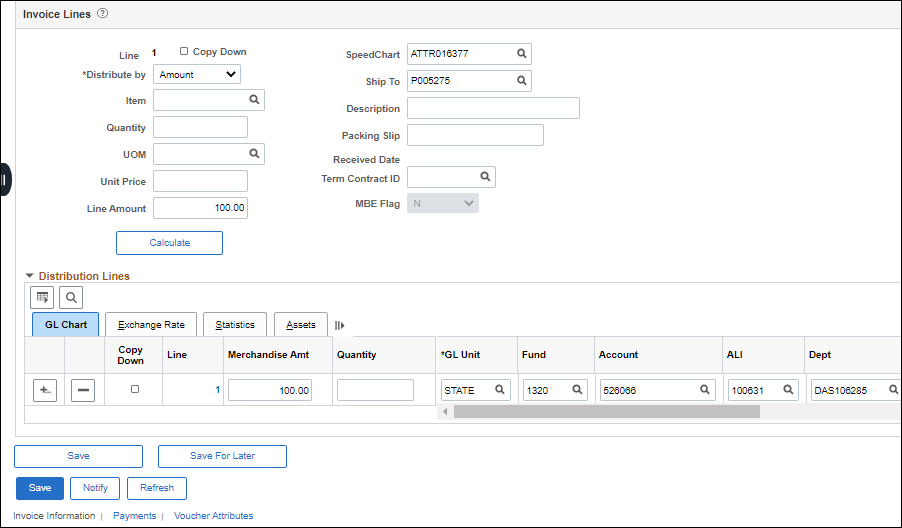

It is possible to charge the entire amount of the voucher to a single ChartField distribution line or split the cost into multiple distribution lines. For example, two distribution lines can be used to split the cost between two different departments or divisions. However, the total of the Amount field on all the distribution lines must equal the amount displayed in the Total field.

Enter the lesser of "current charges" or "balance due" as it appears on the invoice in the Invoice Total field.

Exclude late payment fees (unless the payee and service is a utility regulated by the PUCO.

Exclude past charges.

The Invoice Total amount is populated based on the unliquidated amount remaining on the PO. The amount in the Invoice Total field should equal the invoice amount; update this field if necessary.

It is possible to charge the entire amount of the voucher to a single ChartField distribution line or split the cost into multiple distribution lines. For example, two distribution lines can be used to split the cost between two different departments or divisions. However, the total of the Amount field on all the distribution lines must equal the amount displayed in the Total field.

Enter the lesser of "current charges" or "balance due" as it appears on the invoice in the Invoice Total field.

Exclude late payment fees (unless the payee and service is a utility regulated by the PUCO.

Exclude past charges.

The Invoice Total amount is populated based on the unliquidated amount remaining on the PO. The amount in the Invoice Total field should equal the invoice amount; update this field if necessary.

It is possible to charge the entire amount of the voucher to a single ChartField distribution line or split the cost into multiple distribution lines. For example, two distribution lines can be used to split the cost between two different departments or divisions. However, the total of the Amount field on all the distribution lines must equal the amount displayed in the Total field.

In some instances, agencies must consider the cost per individual item being purchased to determine if the goods should be considered a supply or equipment.

If the invoice contains both equipment and supplies (items with a per unit cost of $1,000 or more and items with a per unit cost less than $1,000), each line item must be coded accordingly and placed on separate lines on the voucher.

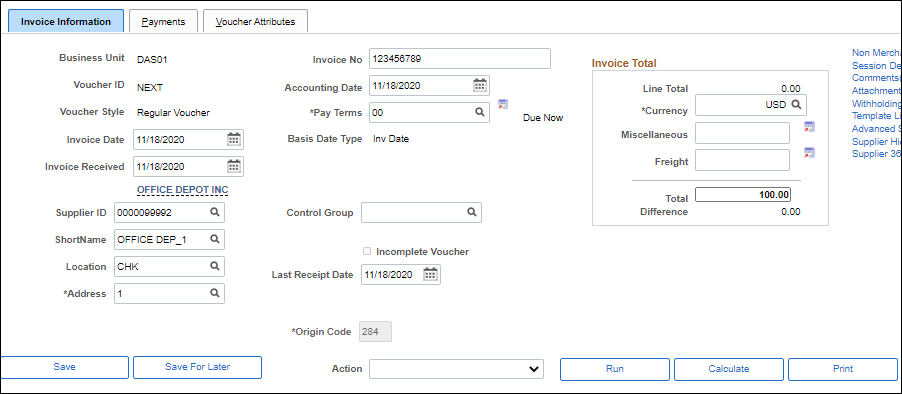

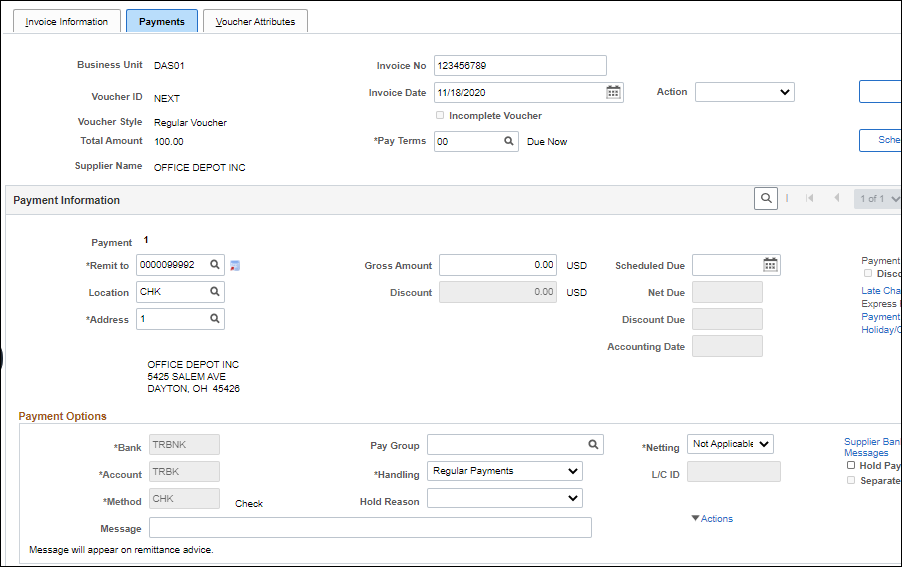

Use the Location field to specify what payment method will be used to pay the payee. The default location is CHK for warrant.

The Address field contains the address from which the invoice was received. The address located in the Payment Information section indicates where the payment is to be sent.

Often, payees will use a different address from the address shown in their letterhead to receive payments, known as a "remit to" address. Use this Address field to indicate where the payment will be sent.

The Bank and Account fields are not editable. They specify the account from which payment is drawn.

The Method field displays the payment method for a voucher. The Method field cannot be edited; it is determined by the location entered.

Add a Payment Message.

Select the Hold Reason .

Remember to resolve the reason for the hold and to remove the hold as quickly as possible.

The Reference field currently does not display any information. Once the voucher is saved and the pay cycle occurs, OAKS FIN displays the warrant or EFT reference number in this field.

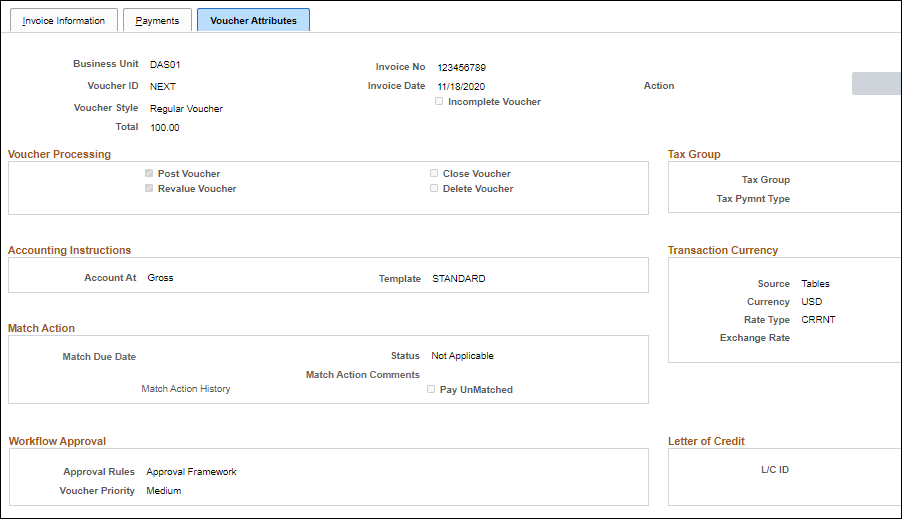

The Approval field specifies whether the voucher goes through approval workflow.

The Approval Rule Set field displays how many levels of agency approval are required for this voucher.

Review the voucher information, such as accounting instructions and approval information.

The voucher processor can change the Pay Terms on the voucher during voucher creation; however, once the voucher is saved, OBM Financial Support Services must be contacted to revise the scheduled payment terms if necessary.

Click the Invoice Information link or tab to go back to the Invoice Information page.

The Print button allows the agency to print a voucher.

Click Save or Save For Later.

The Save for Later function allows users to save vouchers that are in progress but not completed; users can come back later to complete the voucher. The following details are required in order to use the Save for Later functionality.

Payee Information

Account Code

Last Receipt Date

Invoice Date

After a voucher is saved for later, a voucher number will be created, but no voucher balance or combo edit checks will be performed. OAKS FIN automatically assigns the next sequential number in the Voucher ID field. A status of Incomplete (“I”) will be displayed and the voucher will not be routed for approval. Instead, it will go into a recycled status and be displayed in the Voucher Processor’s WorkCenter.

Another Voucher Processor with the same security may complete the pending voucher.

| Click here to request updates to this topic. |

|