Revised: 10/07/2024

Correcting Budget Check Exceptions

OAKS FIN automatically budget checks the vouchers when created, posted, closed, or deleted. The budget check process checks budget appropriation (spending authority) and cash. Sometimes vouchers fail the budget check process and OAKS FIN assigns the budget header status to 'Error in Budget Check'.

Budget exceptions should be monitored daily.

Two common budget check errors may be received in Accounts Payable:

- No Budget Exists - The coding on the voucher does not have a budget.

- Exceeds budget and is over tolerance - The amount on the voucher exceeds the amount in the budget.

These errors may be resolved by:

- Updating all or part of the ChartField string on the voucher to reflect a correct budget.

- Adding appropriation or cash to the budget.

If the voucher has exceeded the budget, the budget officers at the agency have security access in OAKS FIN to update or correct the budget. Notify the budget officer for the agency or division when a budget needs correction. When the agency budget officer corrects the budget, OAKS FIN automatically runs budget checking and resolves the problem.

OAKS FIN does not issue a Warrant (Check) until the budget check exception is resolved.

If the budget check exception is not resolved in a timely manner, the agency may lose some time-dependent discounts with suppliers, such as 2/10 net 30.

Troubleshooting Options

- Detailed transaction lines are coded incorrectly. If one of the ChartFields was entered incorrectly, simply change the code in error.

- A new ChartField may need to be requested by the Chief Fiscal Officer or designee.

- An agency budget may need to be created by the Chief Fiscal or designee.

- A central budget may need to be initiated by the Chief Fiscal Officer or designee.

- To find a valid account to transact against, go to the CC_ACCOUNT Tree and select an account that rolls up to the correct account. The same process can be used for other ChartFields when using the correct budget translate tree. Access to some of the trees may be restricted based on security of the user.

Steps

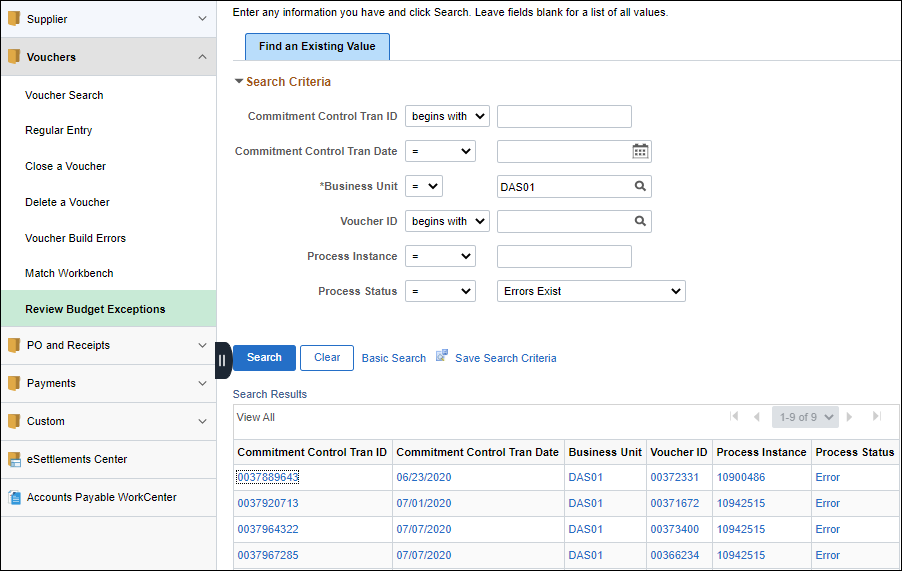

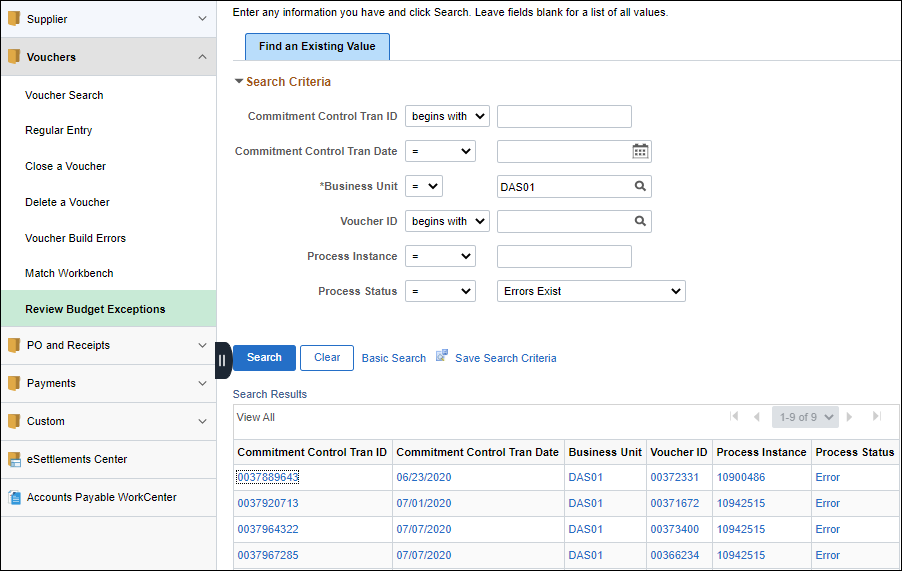

- Enter the Business Unit.

- Select "=" on the first Process Instance dropdown list.

- Select "Errors Exist" on the second Process Instance dropdown list.

- Click Search .

- Click on the exception to view in the Search Results list.

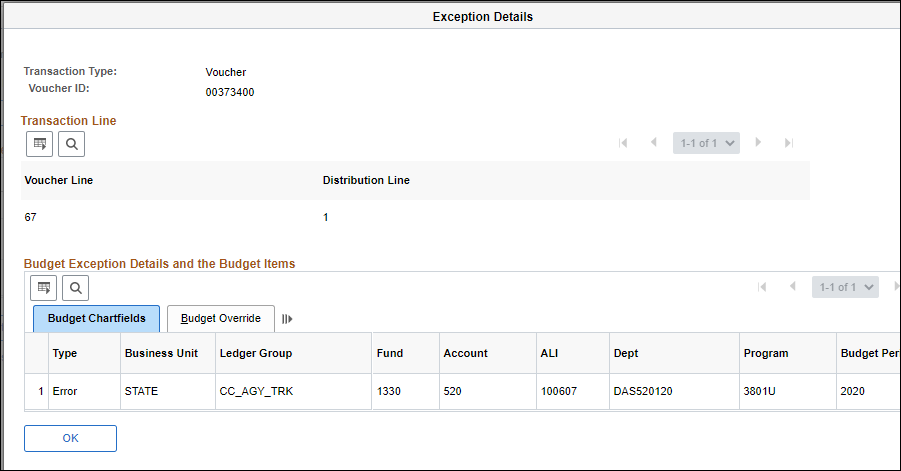

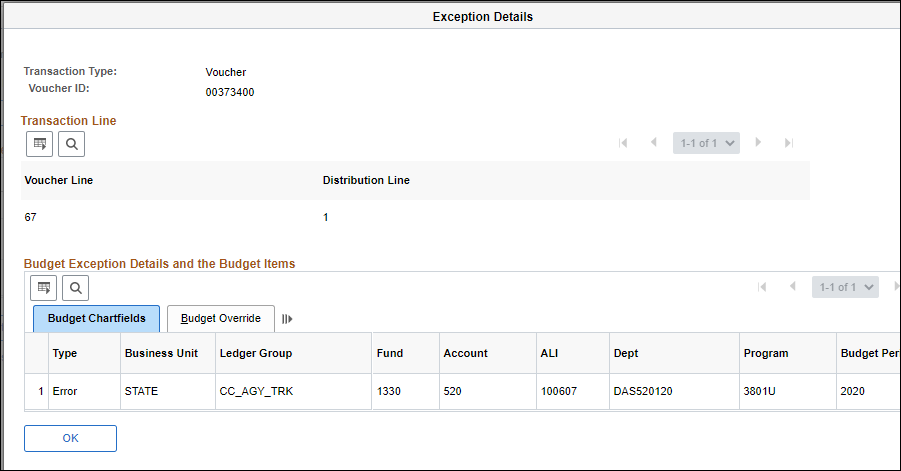

- The Voucher Exceptions tab displays a list of the exceptions, detailing the type of exception that occurred.

- If only one result matches the criteria, the exception itself displays rather than a one-item results list.

- After conducting a search, click the Recent Search Results icon at the end of the breadcrumb navigation anytime to display the Recent Search Results in a pop-up window.

- Click the Line Exceptions tab to view the voucher line that causes the error.

- Click the Line ChartFields sub-tab to view the voucher line accounting information.

- Click the Line Amount sub-tab to view the voucher line amount. Alternatively

- Click the View Exception Details button next to the tab to see all the Line Items.

- Write down the Voucher ID.

- Click the New Window link.

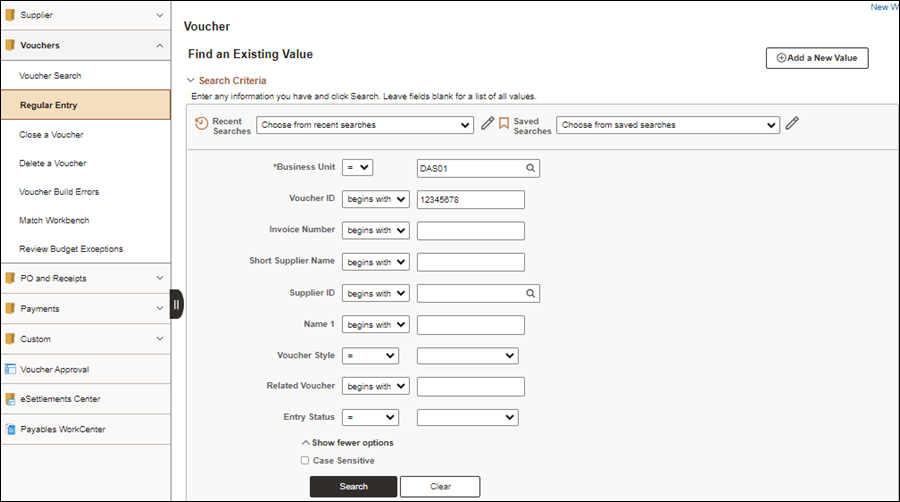

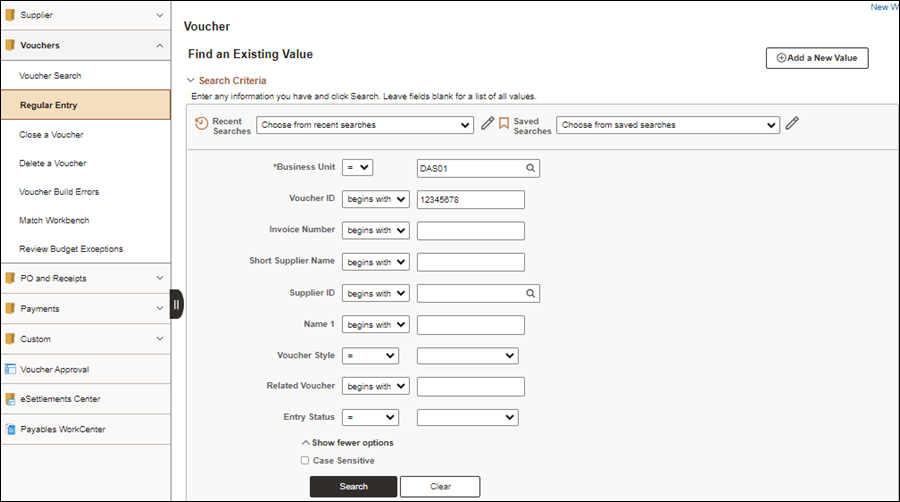

- myOhio.gov > OAKS FIN > Accounts Payable Tile > Vouchers menu > Regular Entry

- Click the Find an Existing Voucher tab.

- Enter the Business Unit.

- Enter the Voucher ID .

- Click Search.

- The Voucher displays.

- Click the Invoice Information tab.

- Edit the ChartFields as necessary.

- Click Save.