Revised: 10/10/2022

This online, single-source repository contains step-by-step processes and procedures for tasks completed in OAKS (PeopleSoft) Financials for the State of Ohio.

Refer to the "Submitting a Documentation Change Request" topic to request an update to any of the information listed within the OAKS FIN Process Manual.

Although the OAKS FIN Process Manual is a virtual document intended for online use, many of the modules listed in the Table of Contents allows sectional printing to accommodate various learning preferences. Keep in mind that online tools and resources throughout the modules, such as embedded links, dropdown images, and pop-up information, will be lost in printing. Additionally, revisions to content is maintained frequently, making printed material on the subject matter obsolete. We discourage printing of manuals due to their short reference use and its consumption of paper resources.

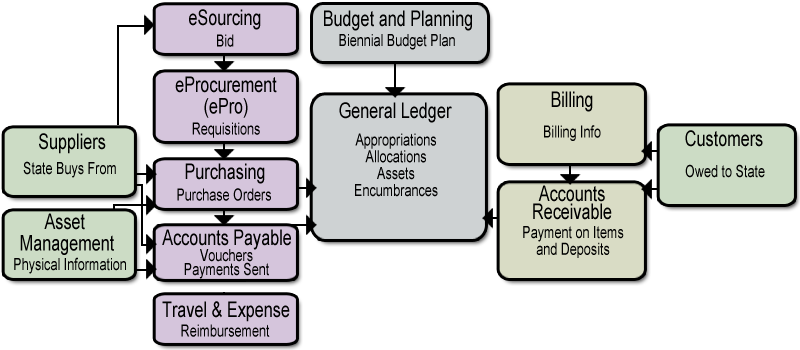

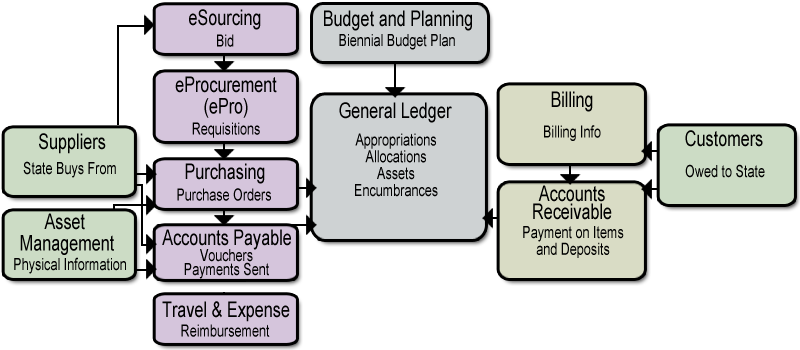

The Ohio Administrative Knowledge System (OAKS) is a statewide, web-based Enterprise Resource Planning (ERP). OAKS FIN uses modules to keep track of every accounting transaction for the state of Ohio. The modules include:

Each module performs specific activities that work together for specific purposes in accordance with the budget.

The budget plays a central role in the state’s financial management system, OAKS Financials. The state operates on a 2-year budget cycle. The General Assembly passes a biennial budget bill. There are separate 2-year budget cycles for operating and capital spending. The operating budget begins with an even fiscal year and covers things like rent, supplies, and paying employees. The capital budget begins with an odd fiscal year and would cover construction projects. Authority to spend state money is granted to each state agency based on determined needs. Most agencies spend from the general revenue fund, or GRF, the state’s largest operating fund that receives revenue from sales, income taxes, federal grants, and many other sources. The Office of Budget and Management, or OBM, implements the budget passed by the General Assembly. OBM loads the authorized spending amounts into OAKS FIN.

Each transaction is broken down into coding called Chartfields. A chartfield is a data field that stores accounting information, affects budget, and is used for internal and external reporting. ChartFields identify where funds are coming from, where they are going to, and the reason for the transaction. Not all chartfields are used depending on the transaction type. The fund, account, and department are required for all transactions and must have budgets assigned to pass, what is called, budget check.