|

|

State Accounting Fiscal Essentials . SAFE Policy Manual |

Revised: 02/06/2025 |

|

|

State Accounting Fiscal Essentials . SAFE Policy Manual |

Revised: 02/06/2025 |

Applicable or Related Code Sections:

ORC 126.21 - Accounting duties of director of budget and management

ORC 5502.22 - Emergency management agency

ORC 5502.25 - Rules of emergency management of state

Related Links

This policy provides general guidance for agencies, offices, boards, and commissions to track the costs of disasters, emergencies, incidences, and events.

This policy applies to all state agencies, offices, boards, and commissions for expenditures made from funds within the state treasury.

Ohio Revised Code section 5502.22 designates the executive director of the Ohio Emergency Management Agency (Ohio EMA) as the state coordinator during emergency response. The executive director of the Ohio EMA is responsible for developing the state Emergency Operations Plan (EOP) which defines the state’s response to disasters, emergencies, incidents, and events and establishes guidelines for activation of the state Emergency Operations Center (EOC).

When costs are incurred for a disaster, emergency, incident, or event in the state, agencies must track those costs for the following reasons:

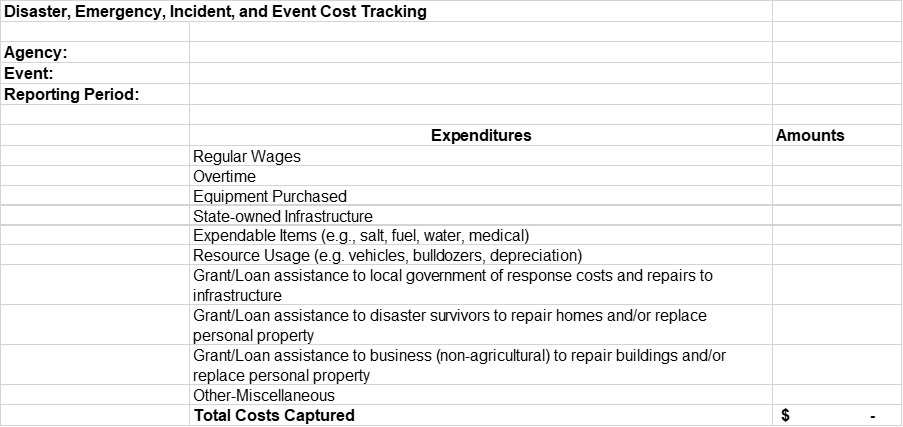

After the state EOC is activated, the Ohio EMA will provide a memorandum to the Office of Budget and Management (OBM) detailing the types of costs that must be tracked and how to report these costs back to the Ohio EMA. Included with the memorandum is a template used to track the associated costs. OBM distributes the memorandum and tracking template to agency fiscal contacts. An example of a template is found below but could change depending on the disaster or incident.

OBM will determine the most appropriate method for tracking the related costs and include it in the distribution to agency fiscal contacts. It is crucial that all agencies use the OBM identified method and communicate this to all staff incurring and paying costs to ensure an accurate and complete accounting of all costs. An agency wide memo stressing the importance of tracking is preferred.

One cost tracking option is to utilize a ChartField such as Agency Use or Reporting Category to track costs in OAKS FIN. If all eleven ChartFields are in use, the agency may be required to track these costs manually.

The use of ChartFields, if available, to track costs will work for most categories of expense with the exception of payroll costs. Payroll costs should be tracked in Kronos or the agency designated time tracking application. If using Kronos, the agency should designate an allocation code to be used by employees coding hours towards the incident. If the agency does not have an allocation code, they can request one to be established through a CRM ticket to DAS payroll. Regardless of the option chosen, agencies should document the payroll dates affected.

Most disaster or emergency expenditures must be completed in an expeditious manner and will likely be made through use of an agency payment card. Agencies are encouraged to use existing internal controls surrounding payment card purchases and communicate the importance of tracking these types of expenditures to ensure accurate tracking. Payment card reconciliation reports may also be used to supplement existing internal controls.

Travel expenses are typically not eligible to be paid with the agency payment card, but travel expenses shall be coded to the incident according to the coding provided in the agency memo.

Agencies or OBM will report the costs incurred in response to disasters, emergencies, incidents, and events to the Ohio EMA on a periodic basis as instructed in the EMA memorandum.