Revised: 10/01/2019

There could be situations where a problem arises between the selling agency and the buying agency, such as:

When the buying agency identifies an improper invoice, such as an incorrect amount was charged, the buying agency will contact the selling agency to correct the issue. If necessary, the selling agency will contact OBM State Accounting to request a voucher deletion.

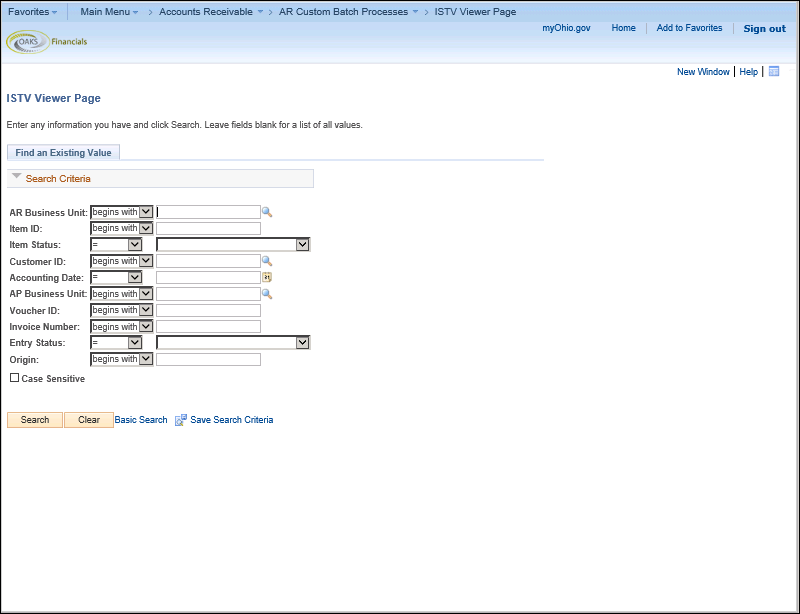

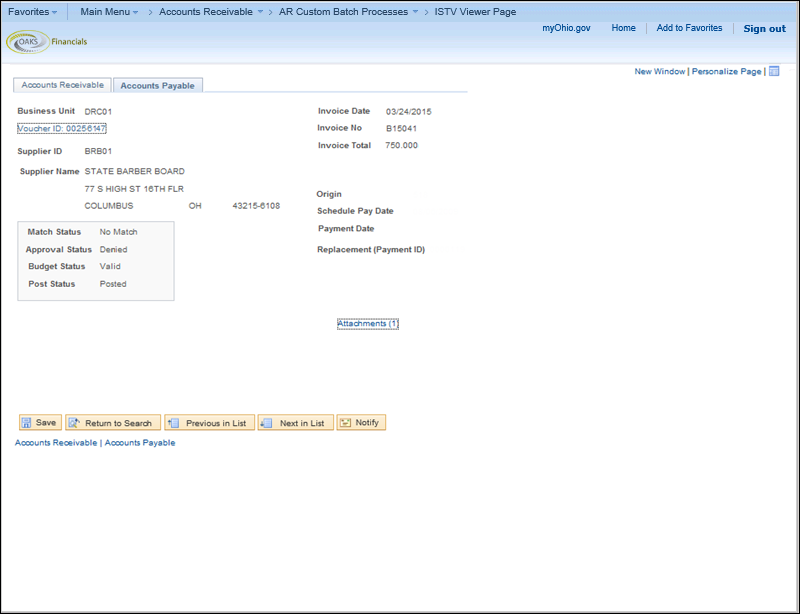

The ISTV Viewer Page is used to search for a specific record in OAKS FIN. Search criteria is entered in order to pull up the specific record between the selling agency and the buying agency. Once a specific record is found, the Account Receivable tab provides information about the bill or item. The Accounts Payable tab provides information about the invoice.

Click the Accounts Payable tab to determine the approval status of the invoice.

Enter the buying agency’s AP business

unit the AP

Business Unit field.

field.

Use the Look up AP Business Unit icon to find the business unit of the agency if it is not known.

Enter the voucher id in the Voucher

ID field.

field.

Click the Search button to start the search.

button to start the search.

icon at the end of

the breadcrumb navigation anytime to display the Recent

Search Results in a pop-up window.

icon at the end of

the breadcrumb navigation anytime to display the Recent

Search Results in a pop-up window.

The specific item’s ISTV

Viewer Page displays.

Click on the Accounts Payable tab.

Review the Approval

Status field to see the status of the invoice.

field to see the status of the invoice.

If the wrong AP origin code was used to route the voucher for approval, the buying agency will seek authorization to approve within their agency. They will not deny the voucher. See Processing ISTV Vouchers for more information.

Both the selling and buying agencies should view the payment status of bills and track if a payment is getting close to being past due. A few proactive steps can be taken by the agencies to help:

If the payment is past due, then the selling agency should contact the buying agency and communicate the issue; it could be resolved quickly and no additional steps are required.