Revised: 02/16/2021

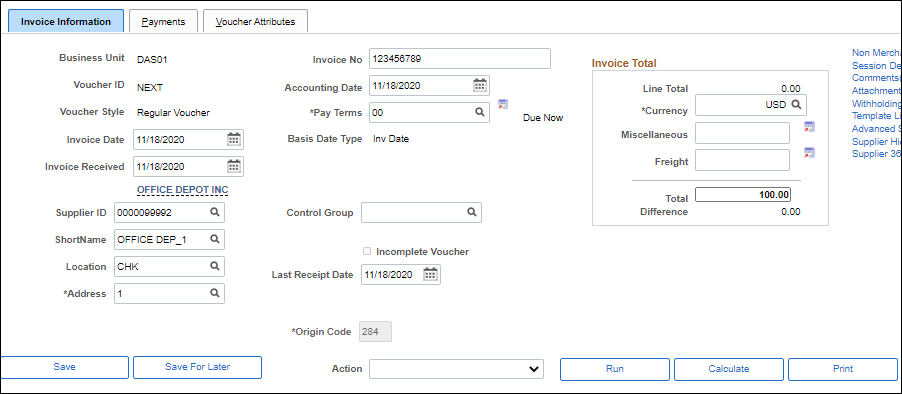

Proper coding of the Last Receipt Date field in OAKS FIN enables the Office of Budget and Management (OBM) to obtain accurate payable data critical to developing the State's annual financial statements.

Spans both fiscal yearsSpans both fiscal years

A number of goods or services received over a period of time that spans both fiscal years:

Examples:

The best date to use on the voucher is the most recent date during the stated service period.

For example, if an invoice covers goods or services received from June 7 to June 14 (a period falling within the same fiscal year), then the best date for the Last Receipt Date field is 06/14/YYYY, the most recent date.

Subsidy VouchersSubsidy Vouchers

For subsidies paid on an advance basis - that is, a recipient is advanced funds to pay expenses not incurred as of the date of the voucher - the best date to use for the Last Receipt Date field is the current voucher date (accounting date-the date the voucher is created in the system).

For subsidies paid on a reimbursement basis - that is, a recipient is reimbursed for actual expenses incurred as of the date of the voucher - follow the standard guidelines above

Partial payments for a Construction ContractPartial payments for a Construction Contract

If the entire construction period falls within the same fiscal year, then the best date for the Last Receipt Date field is the last date falling within the construction period.

For example, if the construction period is stated as June 7 to June 14 then the best date for the Last Receipt Date field is 06/14/YYYY.

If the stated construction period spans both fiscal years, then the guidelines previously set forth (above) for "goods or services received over a period of time that spans both fiscal years" should be applied.

The last receipt date should be based on the period when the architect or engineer has provided services on a construction project, as evidenced by invoices and other documentation.

If the entire service period falls within the same fiscal year, then the guideline previously set forth (

above) for "goods received or services provided over a period of time, but within the same fiscal years" should be applied.

If the service period spans both fiscal years, then the guidelines previously set forth (above) for "goods or services received over a period of time that spans both fiscal years" should be applied.

Employee travel reimbursementsEmployee travel reimbursements

The best date for the Last Receipt Date is the last date of travel reflected on the expense report in OAKS, regardless of whether the travel spans two periods (i.e., if travel commences on June 25 and ends on July 5, the last receipt date would be July 5).

Vouchers for judgement or claimVouchers for judgement or claim

The best date for the Last Receipt Date field is the date when the court or other legal authority issued its order that the judgment or claim be paid.

State-sponsored loansState-sponsored loans

State-sponsored loans to a local jurisdiction, organization, individual, etc., that has been approved for payment.

Petty cash reimbursement requestPetty cash reimbursement request

The best date for the Last Receipt Date field is the current voucher date (accounting date) - the date when the voucher is prepared for payment.

Prepaid expensePrepaid expense

A payment for goods or services that are to be provided in the future (e.g., subscriptions, advance registrations, rent paid in advance, maintenance, etc.)

If the invoice amount is LESS THAN $5,000, then the best date for the Last Receipt Date field is the current voucher date (accounting date-date voucher is prepared).

If the invoice amount is $5,000 or greater and MORE THAN 50 PERCENT of the total dollar amount applies to future goods and services to be received after June 30, then the current voucher date (accounting date-date voucher is prepared) is the best date for the Last Receipt Date field.

If the invoice amount is $5,000 or greater and 50 PERCENT OR MORE of the total dollar amount applies to goods and services received on or before June 30, then the best date for the Last Receipt Date field is a date falling prior or equal to June 30.

Example:

If the charges were incurred within the first fiscal year, then the best date to use for the Last Receipt Date field is 06/30/YYYY. If the charges were incurred within the second fiscal year, then the best date for the Last Receipt Date field is the current voucher date (accounting date-date voucher is prepared), a date falling after June 30.

If the charges were incurred over a period that spans both fiscal years, then the guidelines previously set forth (above) for "goods or services received over a period of time that spans both fiscal years" should be applied.

Payment of a refundPayment of a refund

The best date for the Last Receipt Date field is the current voucher date (accounting date-date voucher is prepared).

Replace a voided Warrant (Check)Replace a voided Warrant (Check)

The best date for the Last Receipt Date field is the same date that appeared in the Last Receipt Date field on the original voucher prepared for the payment.

| Click here to request updates to this topic. |

|