Revised: 10/07/2024

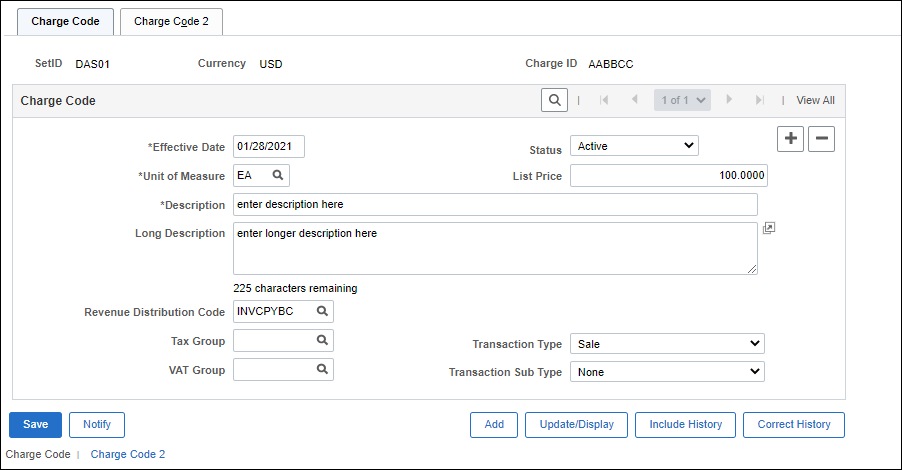

The Charge Code page is used to associate the agency specified Charge ID with the product code, description, unit of measure, unit price, and revenue distribution code for a specific type of service or commodity. The Charge Code specifies this information on customer bill line items.

The charge code is the product, type of service, or fee that is billed to a customer, similar to an agency’s product code when creating an invoice. Instead of entering multiple fields when creating an invoice, only the Charge ID needs to be entered, and the associated charge codes are populated automatically. The Charge ID, Unit of Measure, List Price, and Description fields are printed on the invoice, along with the charge Code ID and its corresponding description, which appear next to each other on the bill line. The long description field (254 characters) does not print on the invoice.

Charge codes are specific to a currency code. The state of Ohio uses only USD as the Currency Code. Defining the Revenue Distribution Code on the Charge Code page will default the revenue accounting distribution on the Accounting – Rev Distribution tab for the bill line when creating the invoice.

| Click here to request updates to this topic. |

|