Revised: 10/07/2024

Creating Payment Worksheets

Overview

Often, OAKS FIN Payment Predictor function can automatically identify the item for which a payment has been received. If the Payment Predictor cannot match a deposit, OAKS FIN creates a payment worksheet, which agencies must use to manually match the deposit. Agencies may also use this process to create a worksheet manually without attempting to use the Payment Predictor.

The worksheet identifies the

item(s) to which a payment should be applied. Note that a worksheet cannot be created manually while the Payment Predictor check box is selected.

Steps

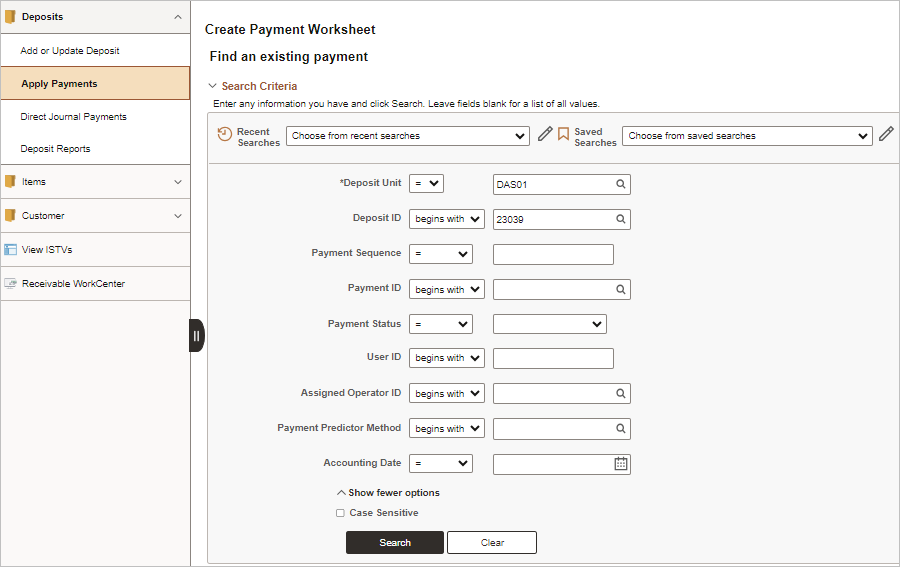

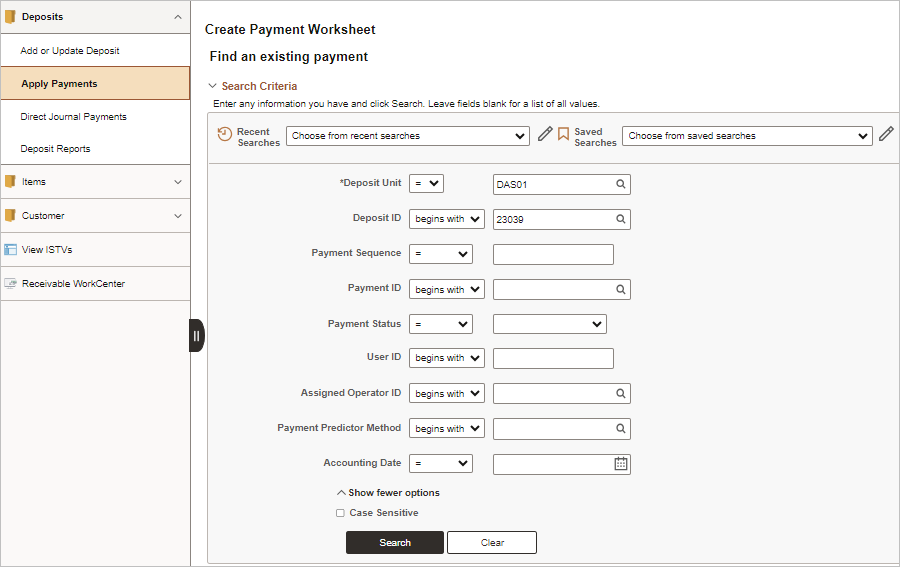

- Enter the Deposit Unit in the

Deposit Unit

field.

- Enter search criteria to locate the deposit. One way to do so is to enter the Deposit ID.

-

Click Search.

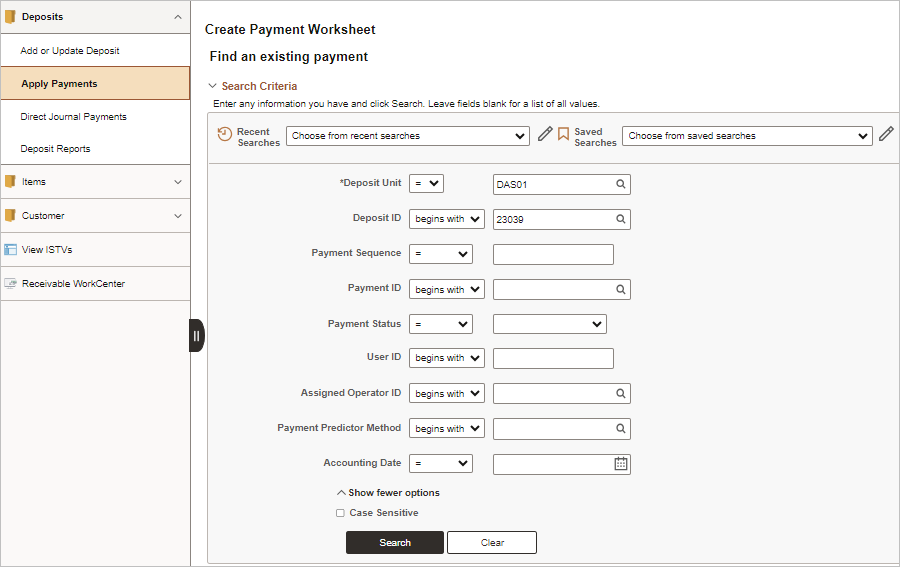

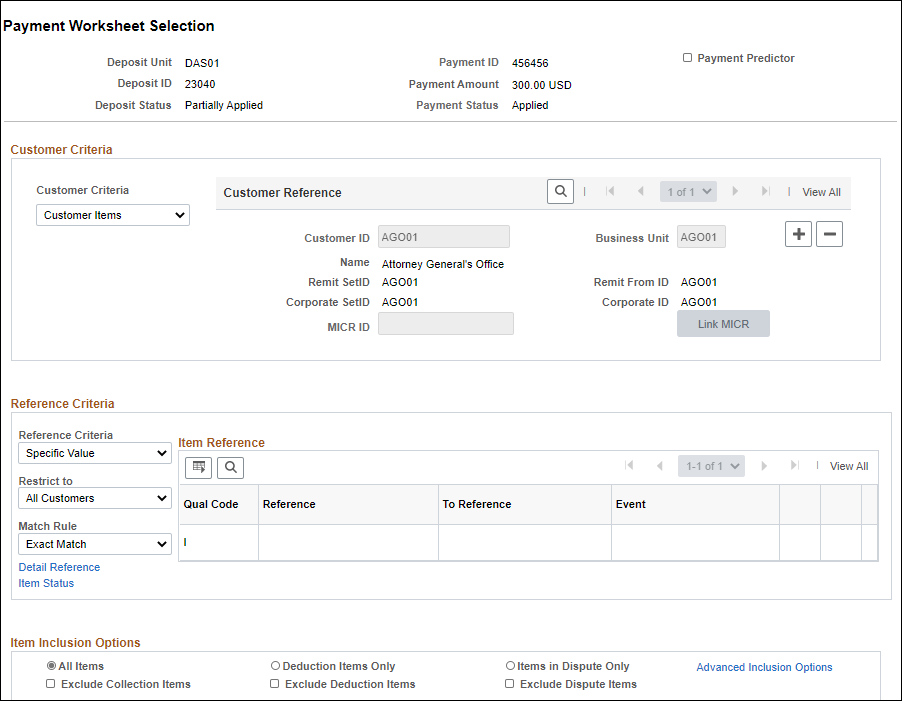

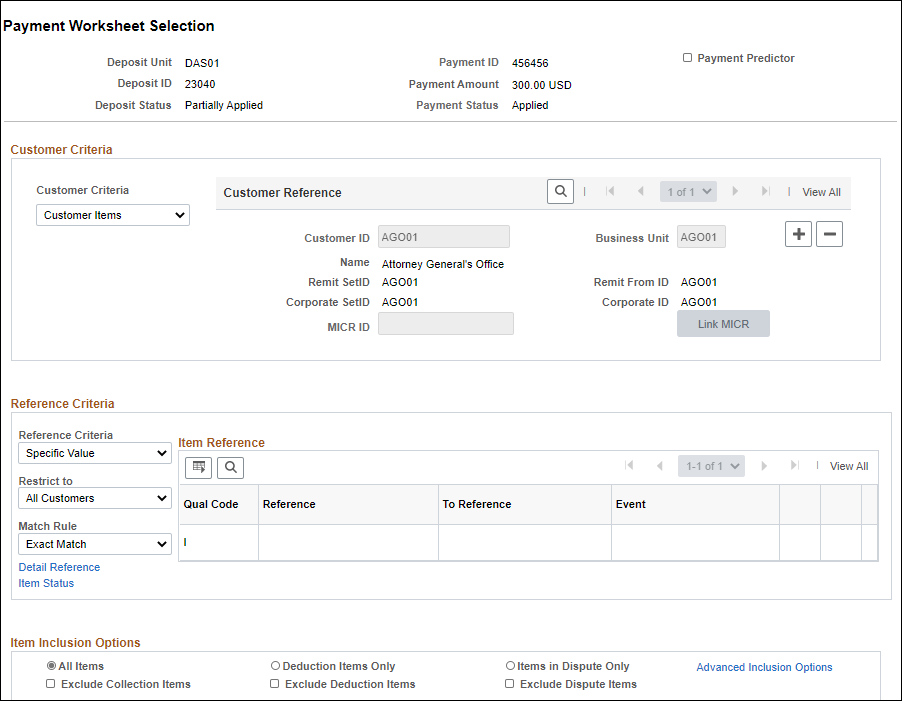

- The selected payment displays on the Payment Worksheet Selection page.

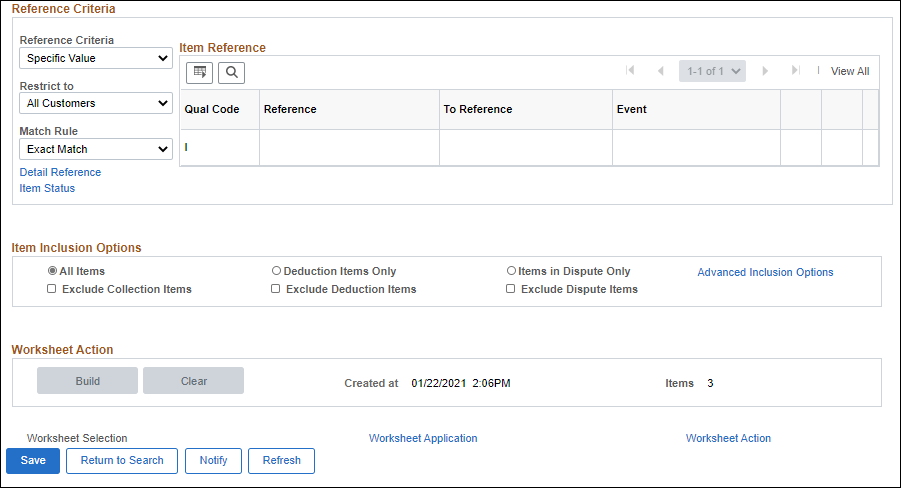

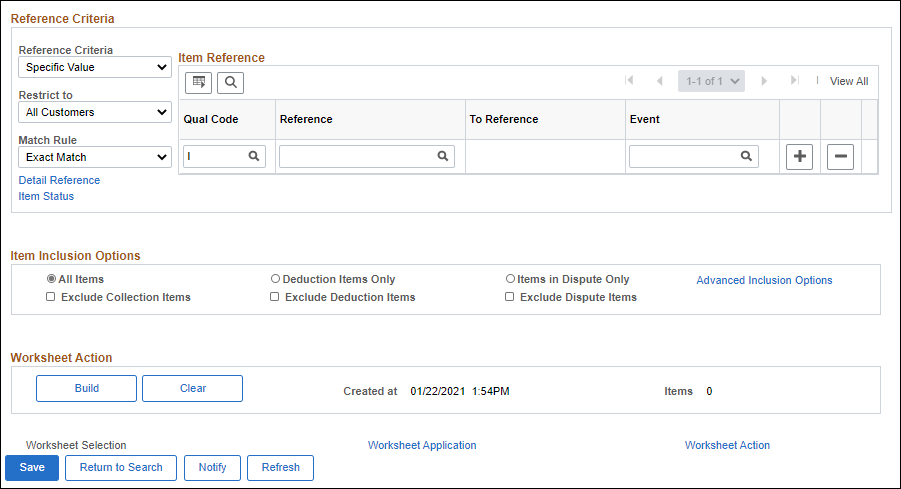

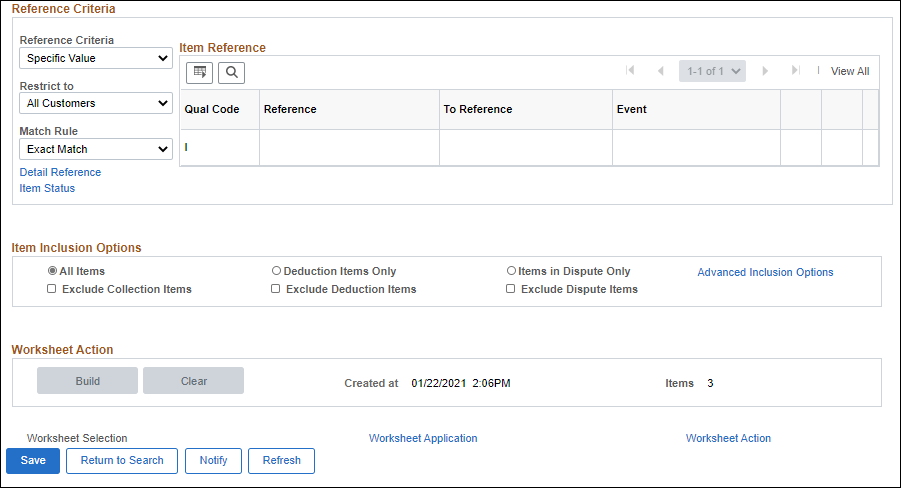

- The Payment Worksheet Selection page is used to refine selections for pending items. OAKS FIN enters items matching the entered criteria on the worksheet. The categories of criteria are:

- Customer Reference –Specific customer

- Item Inclusion Options –Selection of items to include or exclude

- Item Reference –Specific item numbers

- Use the

Customer Reference

section to identify customers whose items are to appear on the worksheets.

- Leave the default values to pull the pending items for the first customer (Customer One, ID CUSTONE). Otherwise, enter a Customer ID.

- Enter the agency-specific code in the Business Unit field to ensure that only the agency’s customers are selected.

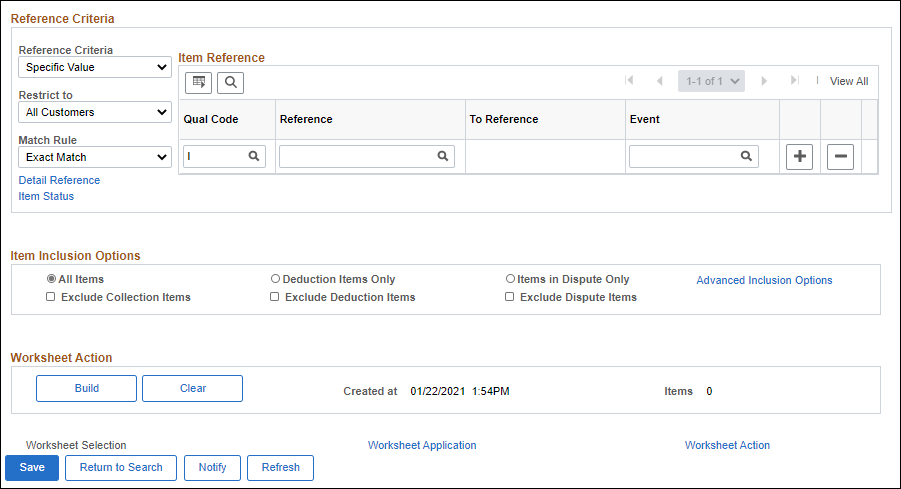

- Use the Item Reference section to identify specific items or ranges of items to include on the worksheet

- Enter the Reference Number in the Reference field.

- Select an Item Inclusion Option from the Item Inclusion Options section to limit the records pulled into the worksheet.

- The Item Inclusion Options include:

- All items

- Items in Dispute Only

- Deductions Items Only

- Click

Build.

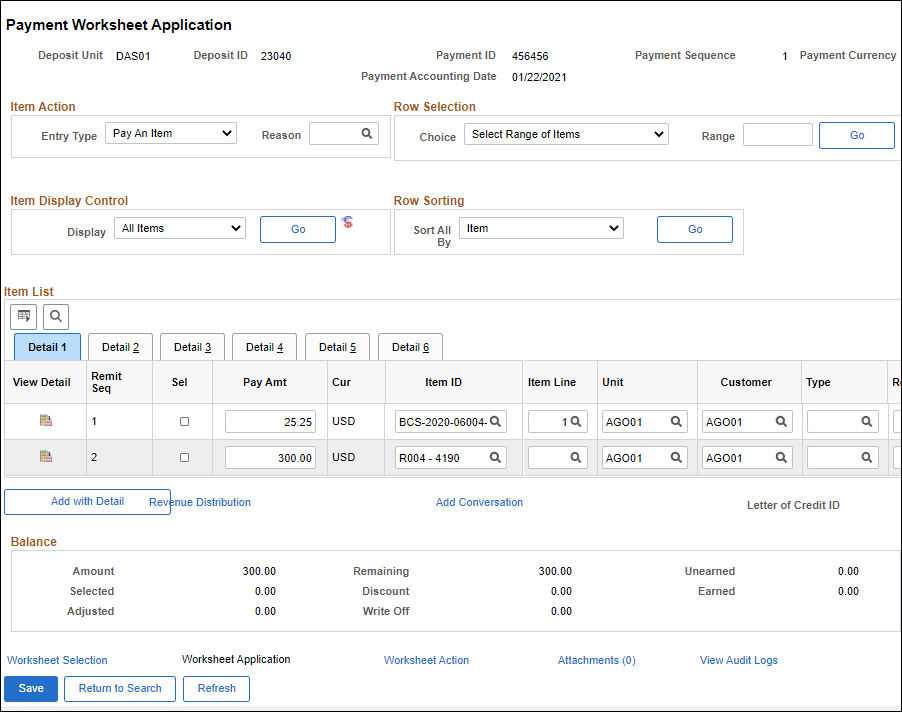

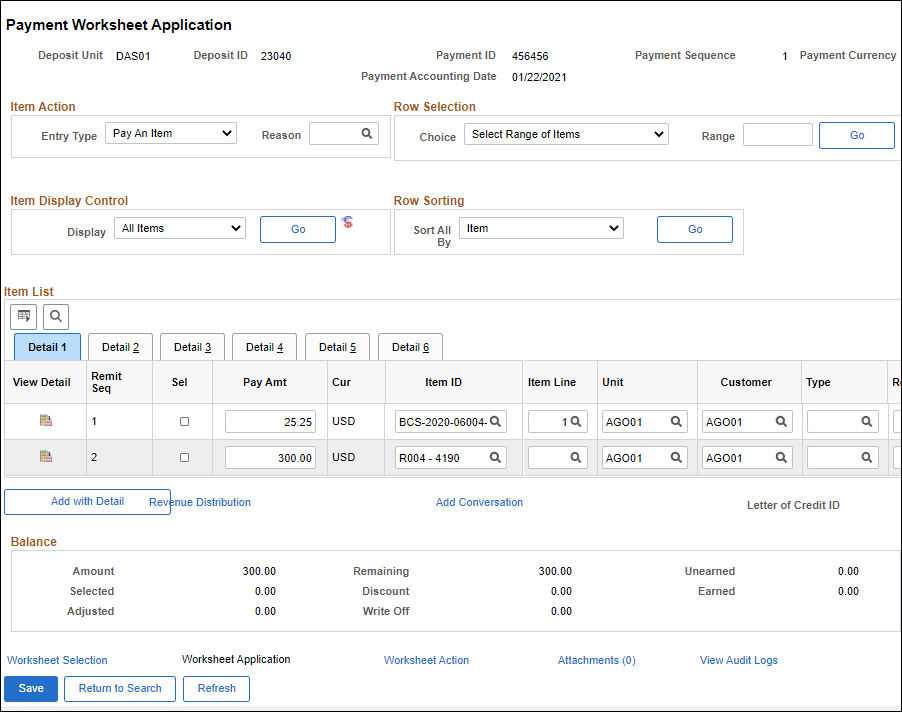

- The Worksheet Application page displays all open items matching the criteria set on the Worksheet Selection page.

- Use the Worksheet Application page to apply the payment to items selected on the worksheet.

- The top line of the worksheet contains the identifying information for the Payment ID being applied

- The

Item Action

section defines the actions and accounting codes to apply to each of the selected items.

- Verify the Entry Type is "Pay An Item."

- If a Qual Code and Reference ID were entered for a specific item on the Worksheet Selection page, the results can be filtered to only see the results for that item by selecting "Selected" from the Display drop-down list.

- Click Go.

- Click the Sel field next to the item (or items) to which the payment is to be applied.

- The Balance section displays the payment Amount , the total amount of items that have been selected in the list, and the Remaining amount of the payment that can be applied towards further open items.

- If part of an item is being paid, edit the Pay Amt field to specify the amount currently being paid.

- The default amount of Pay Amt field is the full amount of the open item.

- Click

Save

to apply payment to the selected

item(s).

- The full payment must be applied before OAKS FIN will allow the payment to save.

- Click the

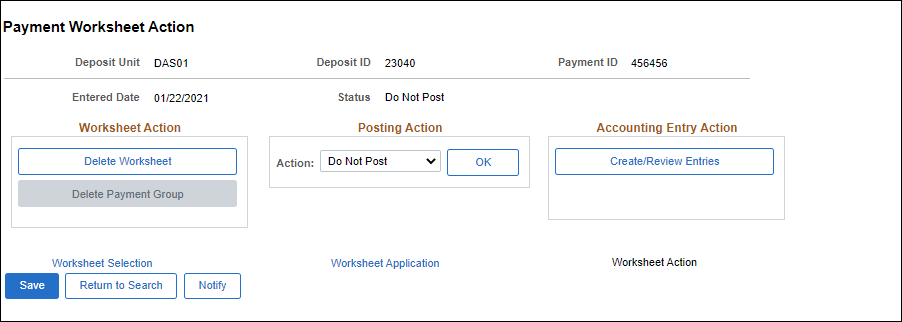

Worksheet Action

link.

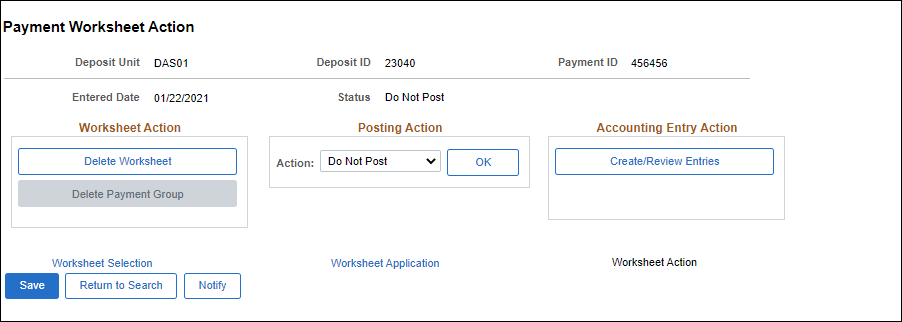

- The Payment Worksheet Action page displays.

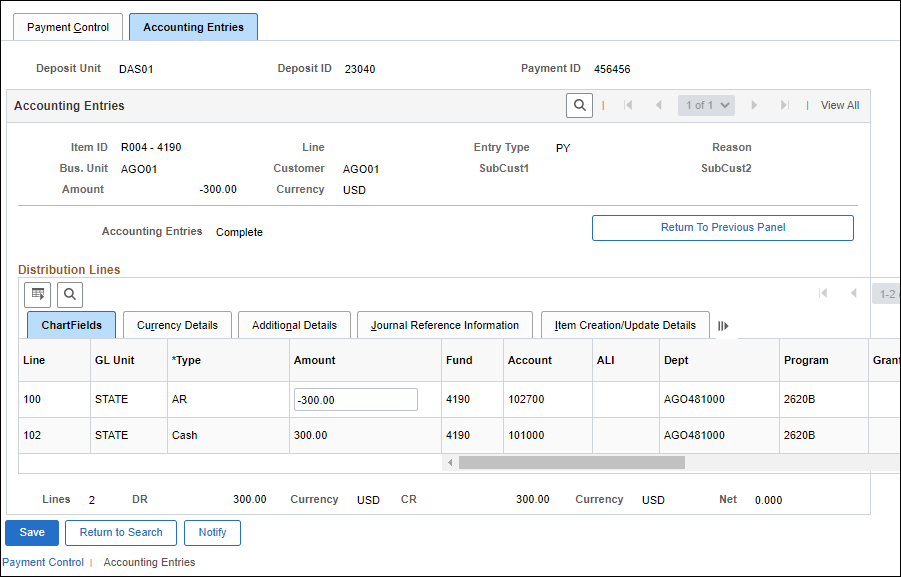

- Click

Create/Review Entries.

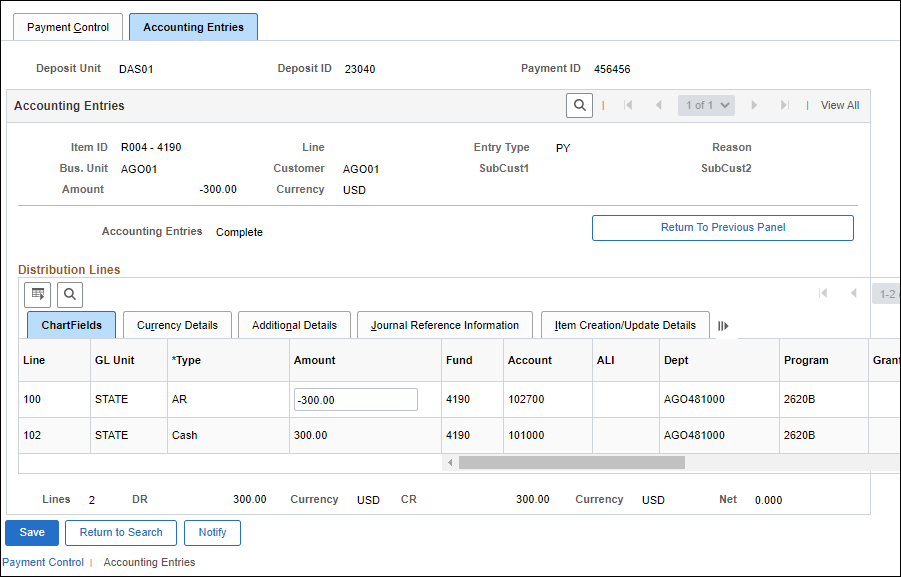

- OAKS FIN displays the ChartField strings on the Accounting Entries tab.

- Review at least the

Fund

,

Account

, and

Dept

fields for accuracy.

- Click

Return to Previous Panel.

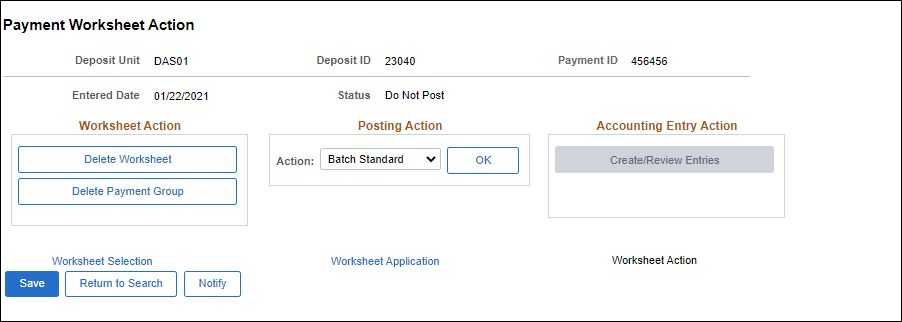

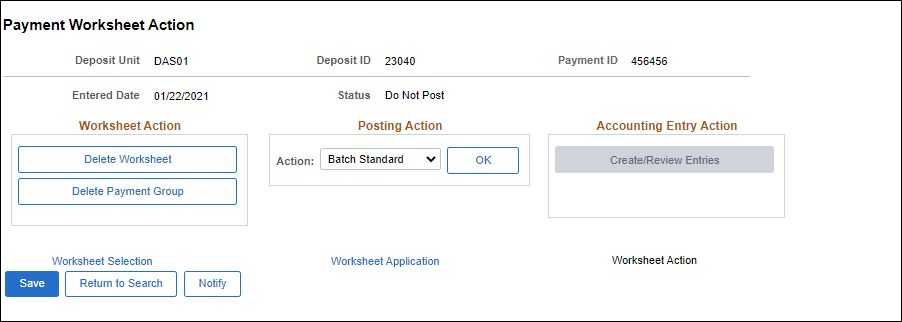

- The Payment Worksheet Action page displays.

- Select

Batch Standard

from the Action dropdown list.

- Click

OK.

- Click

Save.

- Click the

Worksheet Selection

link.

- The Payment Worksheet Selection page displays.

- Click the

Next in List

button to apply the next payment in the batch.

- This process is useful if most or all of the payments in the batch are being applied.

- Instead of clicking Next in List, click

Return to Search

to access more of the payments in the batch.

- This process is useful if the batch contains many payments that are not being applied.