Revised: 10/07/2024

This process is performed after payments have been applied to open items but before OAKS FIN creates General Ledger accounting entries. OAKS FIN does not update the cash balances in the General Ledger until the deposit has been approved by both the agency supervisor and the Treasurer of State’s office (TOS).

The ARUPDATE batch process will update customer accounts prior to approval, but the General Ledger entries are never updated until approved.

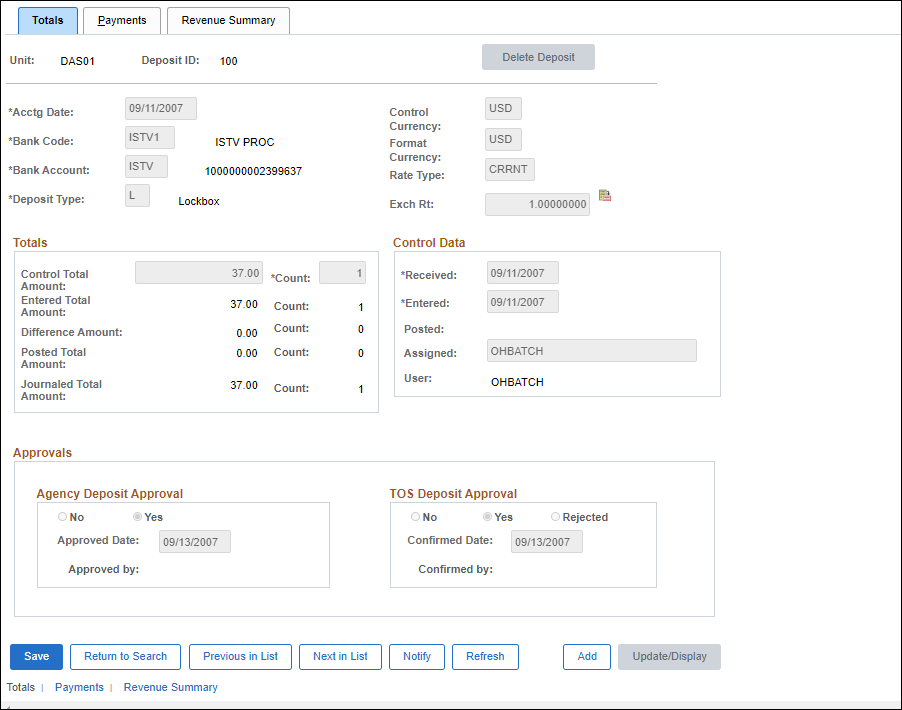

The first approval is performed by the agency supervisor, who verifies that the ChartFields selected are correct. A deposit can consist of payments from customers to be applied to open receivables, miscellaneous revenue receipts to be Direct Journaled, or a combination of both. Only payments from customers are posted, miscellaneous revenues are not. If either the Posted Total Amount, or the Journaled Total Amount, or a combination of both equals the Control Total Amount and Entered Total Amount on the Deposit Total page the Agency Approval Box will be highlighted and the deposit can be approved.

Once approved, groups (batches) are ready for the Treasurer of State's (TOS) office review and processing.

The TOS approval requires that one copy of the OAKS FIN Payment Detail Report accompany each deposit. The report should be specific to the deposit pay-in documents it accompanies. TOS will compare the pay-in documents with deposit information in OAKS FIN and either approve or reject the deposit.

Once approved, the payments are available in OAKS FIN to be picked up by the nightly Budget Check process. After passing the budget check, the Journal Generator process posts the accounting entries to the General Ledger.

The TOS will post the PIBS record that can be used as a receipt for the deposit. The depositing agency can go online to verify the deposit made by TOS. The depositing agency may choose to print a copy of their deposit and attach the treasurer‘s receipt to the report.

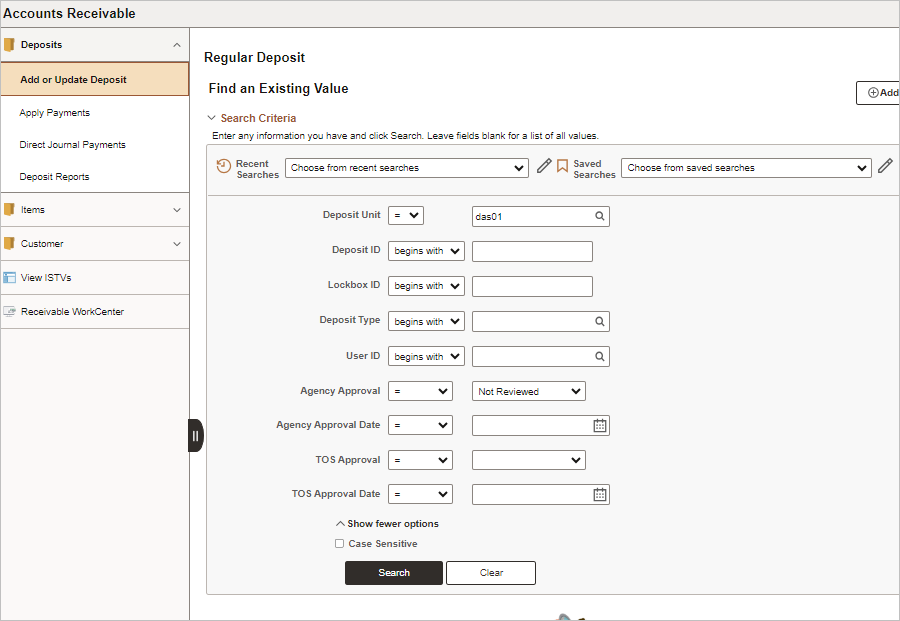

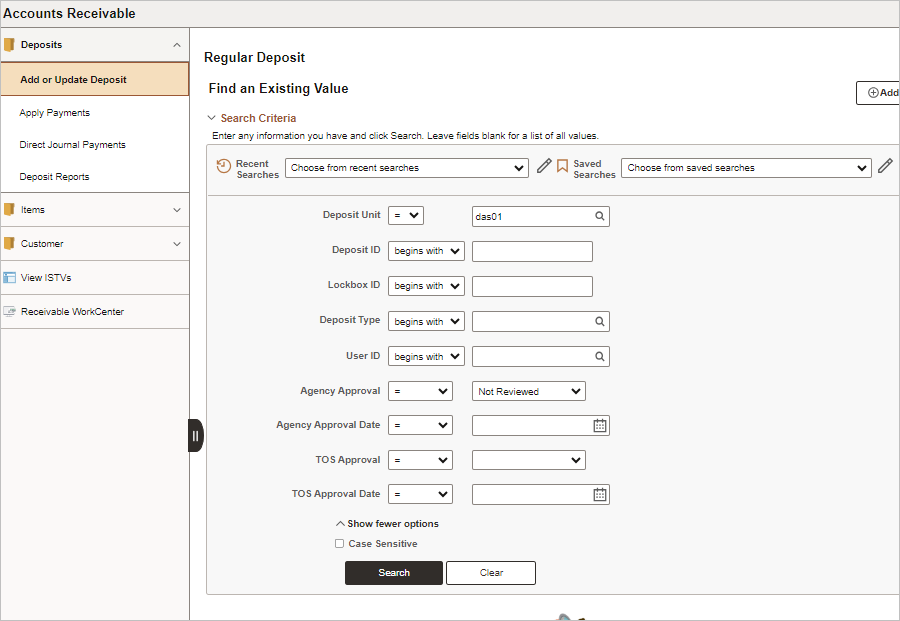

Enter search criteria to find items awaiting approval.

Best practice is for employees to inform agency approvers when deposits are ready to be reviewed. The agency approver can then use the Deposit ID as search criteria.

When looking for an item created by a specific user, enter their ID in the User ID field.

Click Search.

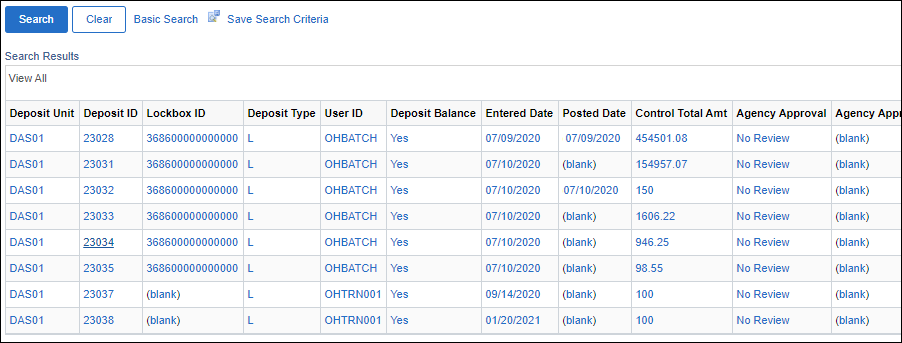

A list of Search Results displays, including all deposit types, e.g. regular deposits, direct journal deposits, lock box deposits.

Click an entry in the list that has a Posted date.

Deposits are eligible for approval when all payments in the deposit have posted to Accounts Receivable via the ARUPDATE batch process.

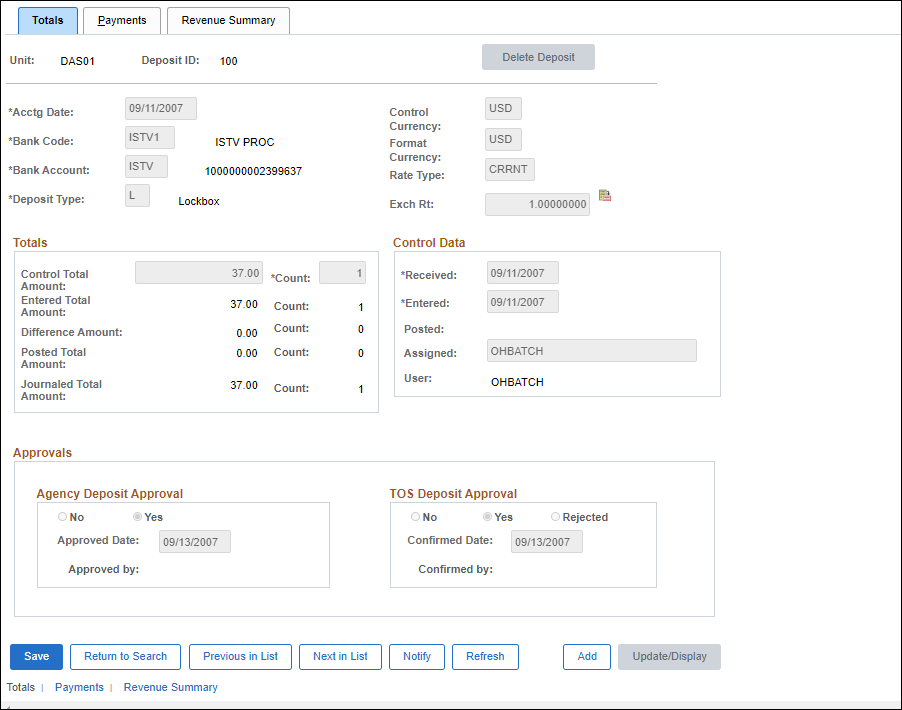

If the deposit is an ISTV, the Bank Code = ISTV and Bank Account = ISTV1.

OAKS FIN automatically approves the deposit at both the agency and TOS levels.

It is not necessary to review the Revenue Summary page prior to approving an ISTV deposit.

If the deposit is not an ISTV continue with these instructions. If the deposit is an ISTV refer to Processing ISTV Deposits.

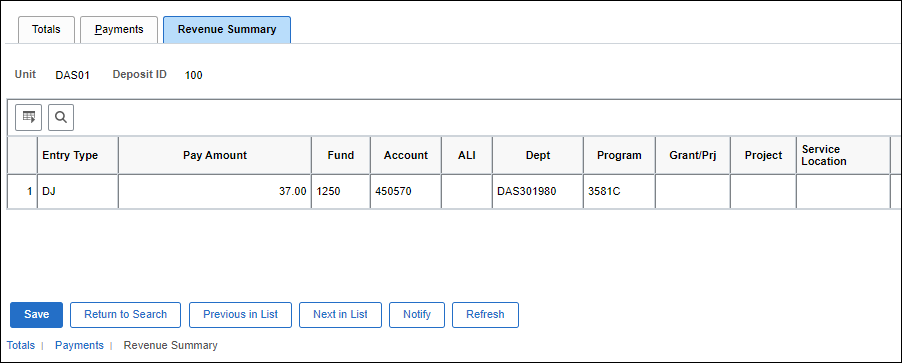

Click the Revenue Summary tab.

Verify that the accounting entries are correct.

Credit revenue accounts (those whose account numbers begin with a “4”) by entering a negative number to increase revenue.

Click the Totals tab.

Select, in the appropriate (Agency/TOS) area of the Approvals section:

Agency Approval

"No" if the ChartFields are incorrect, follow the agency’s process.

"Yes" if the ChartFields are correct.

TOS Approval

"No," if the number and amount on the receipts does not match the payments documented in OAKS FIN, and TOS chooses to make the correction themselves - this is a temporary status before TOS makes the update.

"Yes," if the number and amount on the receipts is accurately reflected in OAKS FIN.

"Rejected," if the number and amount on the receipts does not match the payments documented in OAKS FIN, and TOS chooses to have the agency make the correction.

Click Save.

Click Next in List after approval/disapproval to move to the next item listed in the search results if there are more records to approve.

| Click here to request updates to this topic. |

|