Revised: 10/07/2024

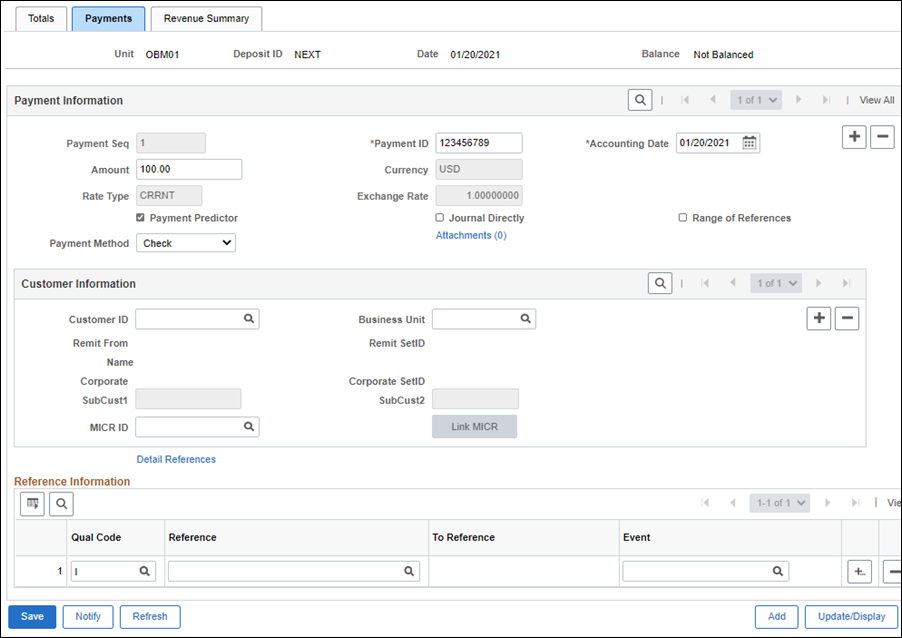

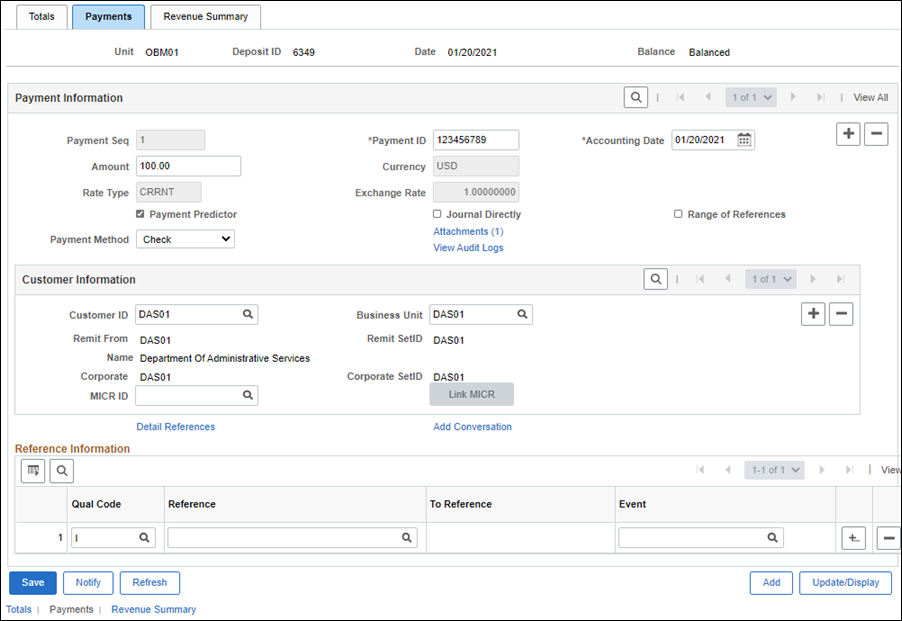

Regular deposits are payments associated with a customer, or miscellaneous receipts. Customer payments are applied to Open items, (items billed but not yet paid) and use the payment predictor or a worksheet to process the payment received.

These instructions assume an open item has already been entered in OAKS FIN and now the user must enter a payment from the customer (rather than a miscellaneous payment.)

|

Deposit Type Code |

Explanation |

Bank Code |

Purpose |

|

A |

AGO Receipts |

State |

This is used for money received that was certified for collection to the Attorney General’s office. |

|

B |

Buy-Back |

State |

This is used to correct deposits for returned checks from the Treasurer of State’s office. |

|

C |

Customer Receipts |

State |

This is used for money received from customers other than state agencies. |

|

D |

Credit Card Receipts |

State |

This is used for money received from the credit card program for Visa/ MasterCard, Discover and American Express credit card files interfaced into OAKS. |

|

E |

Employee Receipts |

State |

No longer used in OAKS. |

|

F |

EFT Receipts ACH |

State |

This is used for money received by EFT at the Treasurer of State. The deposit may be interfaced or manually entered. |

|

L |

Lockbox Receipts |

State ISTV |

This is used for money interfaced by lockbox services. This is money received for ISTV billing. |

|

M |

Miscellaneous Receipts |

State |

This is used for miscellaneous revenue receipts not described in any of the other deposit types (i.e. not associated with a pending item). |

|

X |

Deposit Modifications |

State |

This is used to make zero dollar corrections to posted deposits to correct ChartField errors. |

| Click here to request updates to this topic. |

|