Creating a Single Payment Voucher

The Single Payment Voucher (SPV) exists to reduce the effort required

to make a one-time, small dollar payment to suppliers not in the OAKS

FIN supplier database. Single Payment Vouchers may not be used when:

- the supplier is established and is active in the OAKS FIN supplier

database, or

- the account code being used is reportable to the IRS, or

- the amount of the payment requires a purchase order to be completed.

1099-Reportable Account Codes are not to be used on single payment vouchers.

Payments using any 1099-Reportable Account Codes should be processed on

regular vouchers in order for the transactions to be reported correctly

to the IRS and the payee.

Single Payment Vouchers (SPV) allow agencies to enter vouchers without

referencing a supplier in the OAKS FIN supplier file. The SPV is to be

used only for a refund or a subsidy payment. The SPV can be entered online

in OAKS FIN or submitted via the INF02 Voucher Interface.

SPVs cannot reference an encumbrance. If reference to an encumbrance

is needed for these vouchers, have the supplier entered into the OAKS

FIN supplier file and process it as a regular voucher.

When an SPV is entered online in OAKS FIN, a warrant is issued unless

the agency enters the supplier banking information on the voucher.

- Click here

for assistance with accessing the OAKS FIN AP Module.

Steps

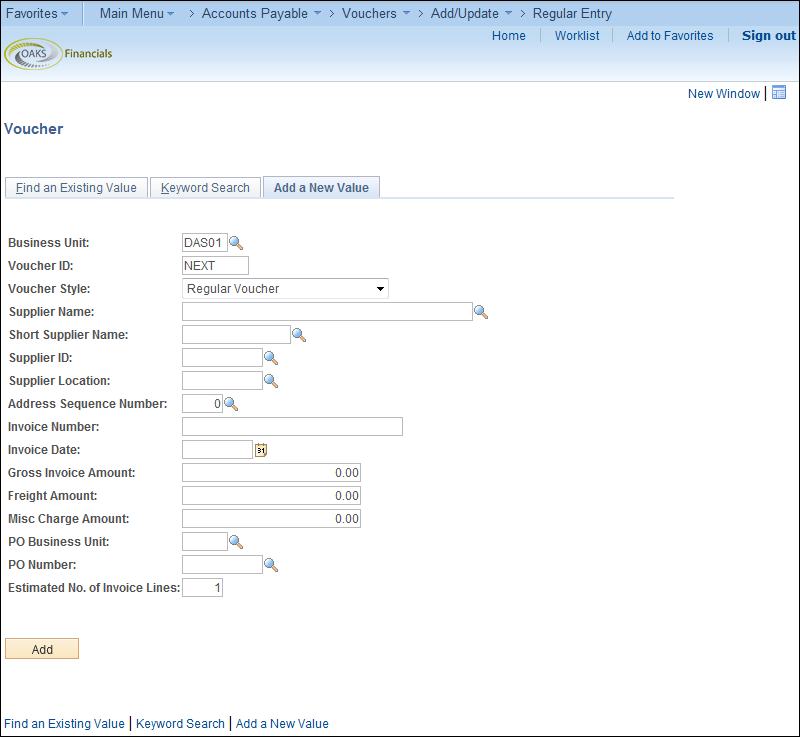

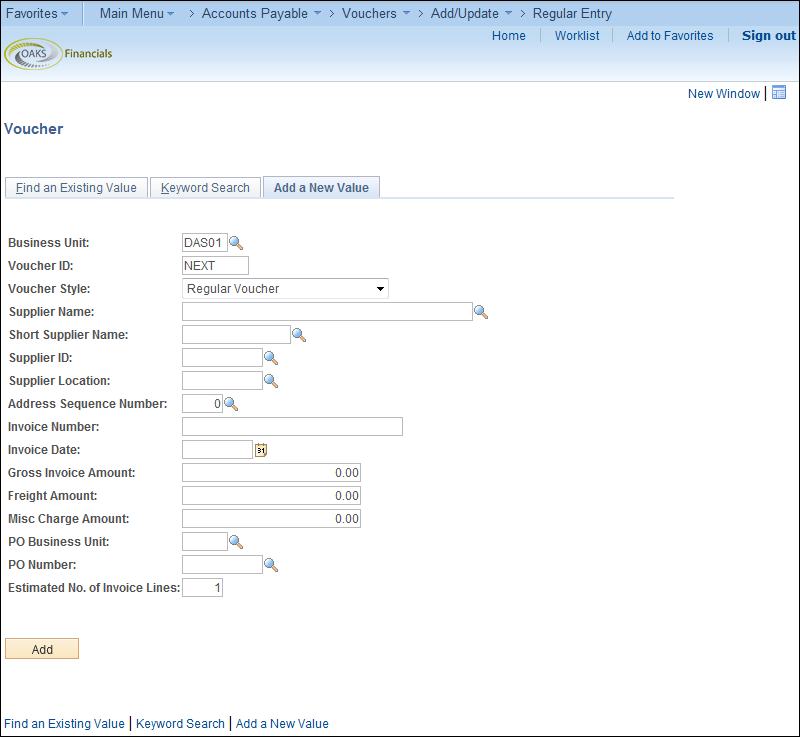

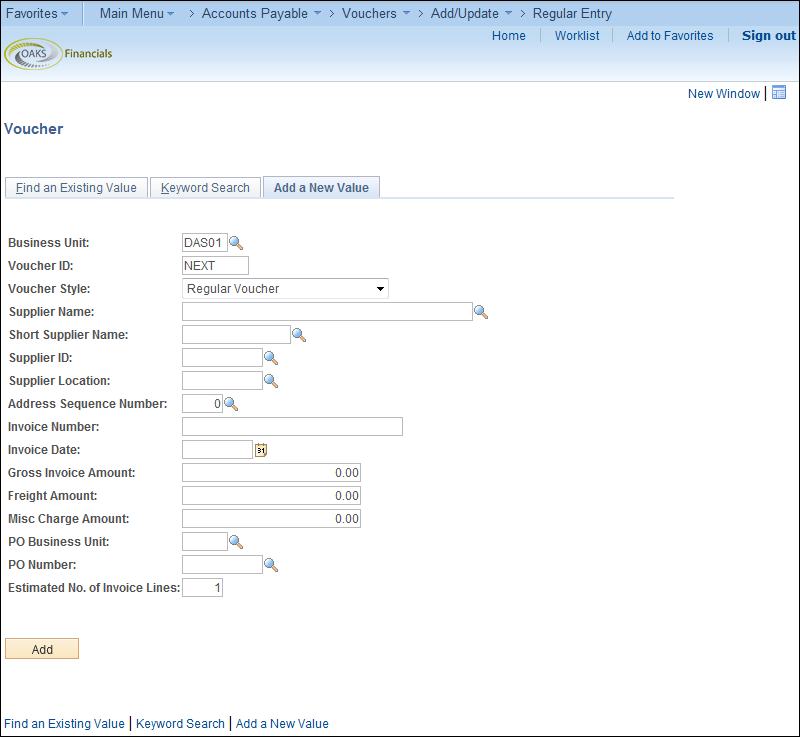

- myOhio.gov

> OAKS FIN > Main Menu > Accounts Payable >

Vouchers > Add/Update > Regular Entry

- Select Single

Payment Voucher from the Voucher

Style

dropdown list.

dropdown list.

- Enter a single payment ID in the Supplier

ID

field. This varies depending on whether the

type of supplier and how they will be paid.

field. This varies depending on whether the

type of supplier and how they will be paid.

- SGLPAYEFT2

- Single Payment EFT (electronic payment) supplier

- SGLPAYCHK2

- Single payment warrant supplier

- SGLPAYBNF2

- Single Payment Benefits EFT supplier

- SGLPAYMED2

- Single Payment Medicaid EFT supplier

- SGLPAYTAX2

- Single Payment TAX EFT supplier

- Click Add

.

.

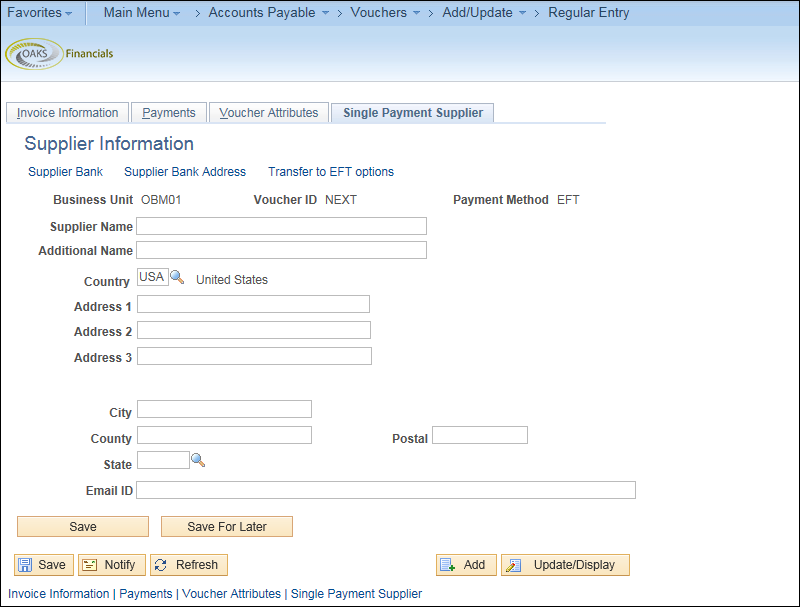

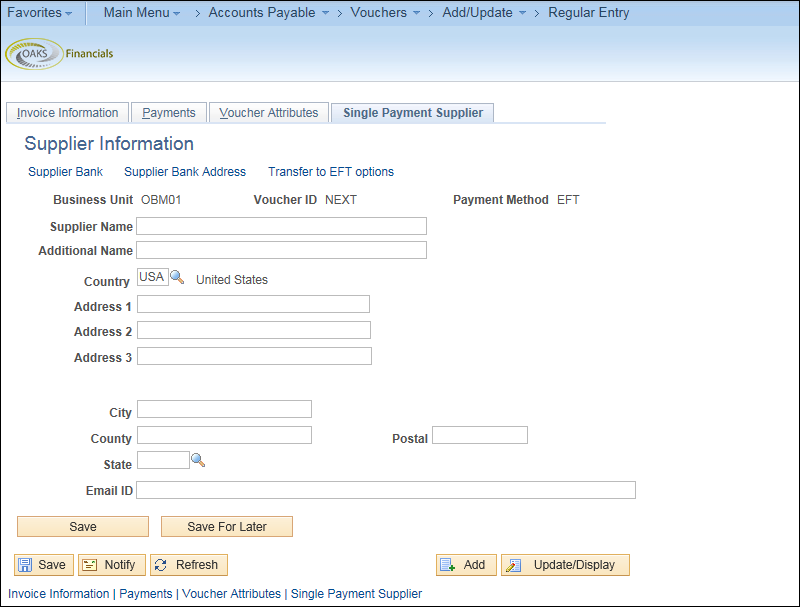

- The Single Payment Supplier

tab displays

- Enter the supplier name in the Supplier

Name

.

.

- This data does not become part of the master

supplier file.

- Enter the street or postal address

of the supplier in the Address

1

field.

field.

- Enter the supplier's City

.

.

- Enter the supplier's zip code in the

Postal

field.

field.

- Enter the supplier's State

.

.

- If supplier "SGLPAYEFT2"

was selected as the Supplier ID for electronic transfer, enter the

supplier's bank information.

- Only enter supplier bank information if the

supplier is being paid by EFT.

- Click the Supplier

Bank

link.

link.

- Enter the supplier's

bank account number in the Bank

Account Number field

.

.

- The Depository Financial Institution

DFI

Qualifier

is only used for Electronic

Funds Transfer and is not appropriate for single payments.

is only used for Electronic

Funds Transfer and is not appropriate for single payments.

- Enter the bank

Account

Type

.

.

- Click OK

.

.

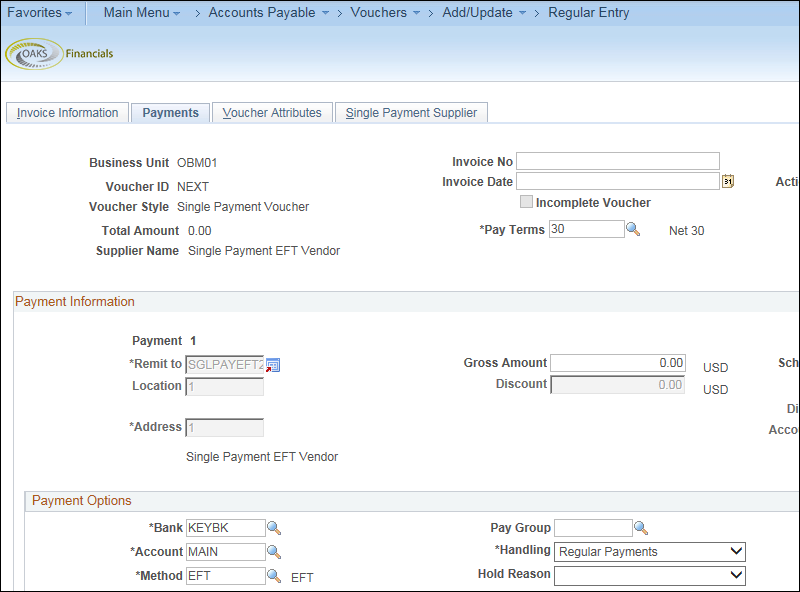

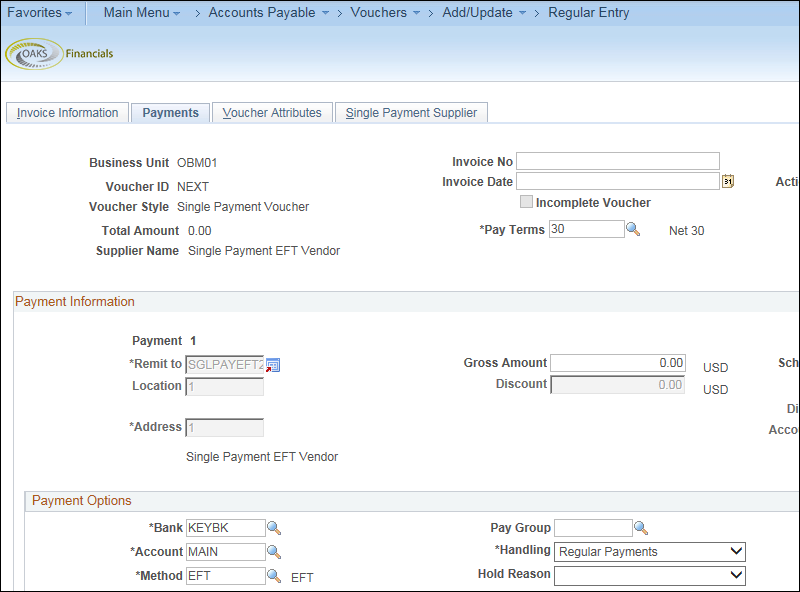

- Enter the payment method in the Location

field.

field.

- EFT - Electronic Funds

Transfer

- CHK - Warrant (check)

- Enter the time line for voucher payment

in the Pay

Terms

field.

field.

- Net 30 - Payment is

due in 30 days.

- 2/10 Net 30 - The supplier

offers a 2% discount for payment within ten days; otherwise, payment

is due in 30 days.

- Due Now - Payment is

due immediately.

- Click here for Pay

Term guidelines

- Enter the supplier's Invoice

Number

.

.

- This is the number on the invoice

from the supplier. OAKS FIN uses this number as a reference when

checking for duplicates.

- Enter the date printed on the supplier's

invoice in the Invoice

Date

field in MM/DD/YYYY format.

field in MM/DD/YYYY format.

- Discount calculations are based on this field.

- Enter the current date by typing "today" in the field.

- An agency‘s responsibility to make prompt payment does not

begin until the agency receives a proper invoice as defined by

OBM Rule 126-3-01 (A)(4-5). If the agency receives a defective

or improper invoice from a supplier, there are certain responsibilities

under the Ohio Administrative Code. OBM Rule 126-3-01 (B)(4)(b)

details the actions to take upon receiving a defective or improper

invoice.

- Utilities regulated by Public Utilities Commission (PUCO) may

bill late payment charges based on the rates approved by PUCO.

This is not subject to ORC 126.30.

- Except for prompt payment fees and PUCO late fees, late charges

of any other type will not be paid.

- Enter the date on which the state

received the proper invoice in the Invoice

Received

field.

field.

- This is not the date on the supplier

invoice. It is the date the invoice was received and deemed a

valid invoice. Interest calculations are based on this field.

- Enter the date on which the goods

or services were received in the Last

Receipt Date

field.

field.

- A correct Last

Receipt Date must be entered. Procedures for determining

the correct last receipt date are issued from OBM/State Accounting.

- Refer to the "Determining

Last Receipt Date" topic for guidance. .

- Enter the lesser

of "current charges" or "balance due"

as it appears on the invoice in the Invoice

Total

field.

field.

- The

total voucher amount must correspond to the invoice amount. An

invoice may not be altered by the agency. If the invoice amount

is incorrect, the agency should request a new invoice from the

supplier, according to requirements of prompt pay legislation.

.

Exclude

"sales tax" listed on the invoice image when the

supplier's "remit to" is in Ohio or when OHIO sales

tax is explicitly stated (other taxes such as excise taxes,

local taxes, environmental taxes, or other types of taxes

are not exempt to the State and should be included).

Exclude past charges.

Exclude

late payment fees (unless the supplier and service is a utility

regulated by the Public Utilities Commission [PUCO]).

- Enter a Description

of the invoice charges.

of the invoice charges.

- An example might be "Overpayment reversal".

- Enter the amount to charge to the

associated ChartFields in the Total

field.

- The total of all amounts entered on the distribution

lines for a voucher line must equal the extended amount on the

invoice line. An error message appears if there is an imbalance.

- Enter the ChartFields

to

be charged by the voucher, including at a minimum:

to

be charged by the voucher, including at a minimum:

- There are five ChartFields that are required for all vouchers:

Fund, Account, ALI, Department, and Program.

- Funds segregate accounting transactions for activities

or objectives and correspond to the fund structure that the

state used in legacy systems.

- The Account ChartField is the highest-level description

for an entry. Account values are classified in five broad

account types: Asset, Liability, Equity, Revenue, Expense,

Transfer In and Transfers Out.

- The ALI (appropriation line item) code is the legal spending

authority authorized by the budget bill.

- The Department is the agency responsible for the cost of

the voucher.

- The Program ChartField describes a discrete activity within

an agency‘s organization that is intended to provide a specific

good or service in response to an identified social or individual

need or problem.

- When using a capital expense

account, the Project ChartField will also become required.

- Leave the GL Unit

as

STATE. This allows all financial reporting to roll up to one

entity.

as

STATE. This allows all financial reporting to roll up to one

entity.

- The appropriate account code

must be used. Account code definitions are issued from the

office of the Administrator of State Accounting. Account code

definitions may be updated periodically during the year.

- Refer to the "OAKS

FIN Account Code Table Online Reference" for assistance.

Click here

for additional guidance regarding supply vs. equipment account

codes.

for additional guidance regarding supply vs. equipment account

codes.

- 1099-Reportable Account Codes are not

to be used on single payment vouchers. Find the 1099-Reportable

Account Codes on the OBM website at Reportable

ChartField Value Listing.

- Payments using any 1099-Reportable Account

Codes must be processed on regular vouchers in order for the transactions

to be reported correctly to the IRS and the payee.

- Add Attachments

in the Header.

- Items such as invoices

or backup documentation must be added by the Voucher Processor.

- Select

the Attachments

link.

link.

- The Voucher Header Attachment page displays.

- Click Add

Attachments

.

.

- Browse

to

find the appropriate item and then click Upload.

to

find the appropriate item and then click Upload.

- Click OK.

- The Invoice Information page displays and the number of

attachments is listed next to the Attachments

link

link

- Click the Payments

tab.

tab.

- The Payments page displays.

- The Payments page displays basic information

about how this voucher will be paid. This page also allows the

user to enter or change the payment method, schedule, and payment

options.

-

- A payment can also be put on hold

by selecting the Hold

Payment

checkbox.

checkbox.

- Remember to resolve the reason for the hold

and to remove the hold as quickly as possible.

- Click the Voucher

Attributes tab.

- The Voucher Attributes page displays.

Review the data for accuracy.

If there are inaccuracies, return to the

appropriate page(s) and make corrections as necessary.

Review the voucher information,

such as accounting instructions and approval information.

- The voucher processor can

change the Pay Terms on

the voucher during voucher creation; however, once the voucher

is saved, OBM

State Accounting must be contacted to revise the scheduled

payment terms if necessary.

Click Save

.

.

Unless a hold was placed, the single

payment voucher is routed for approval. After approval, OAKS FIN

performs a budget check, posts the voucher, and creates the payment.

dropdown list.

dropdown list.

field. This varies depending on whether the

type of supplier and how they will be paid.

field. This varies depending on whether the

type of supplier and how they will be paid.

.

.

.

.

field.

field.

lines can be used for multiple-line

addresses.

lines can be used for multiple-line

addresses.

.

.

field.

field.

.

.

link.

link.

.

.

is only used for Electronic

Funds Transfer and is not appropriate for single payments.

is only used for Electronic

Funds Transfer and is not appropriate for single payments.

.

.

.

.

field.

field.

field.

field.

.

.

field in MM/DD/YYYY format.

field in MM/DD/YYYY format.

field.

field.

field.

field.

field.

field.

of the invoice charges.

of the invoice charges.

to

be charged by the voucher, including at a minimum:

to

be charged by the voucher, including at a minimum:

as

STATE. This allows all financial reporting to roll up to one

entity.

as

STATE. This allows all financial reporting to roll up to one

entity.

for additional guidance regarding supply vs. equipment account

codes.

for additional guidance regarding supply vs. equipment account

codes.

link.

link.

.

.

to

find the appropriate item and then click Upload.

to

find the appropriate item and then click Upload.

link

link

tab.

tab.

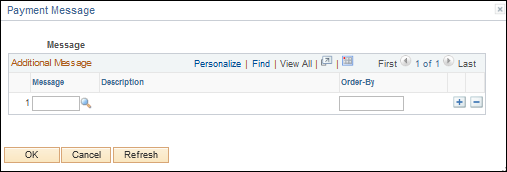

field) or selecting an agency-specific pre-defined message (using

the Messages hyperlink).

Both messages will display on the warrant (CHK) stub (up to 70-characters),

but free-form Messages will

not display on EFT.

field) or selecting an agency-specific pre-defined message (using

the Messages hyperlink).

Both messages will display on the warrant (CHK) stub (up to 70-characters),

but free-form Messages will

not display on EFT.

link in the payment method section.

link in the payment method section.

to select a pre-set message.

to select a pre-set message.

.

.

checkbox.

checkbox.

.

.