Revised: 10/07/2024

Employees of elected officials, the judicial and legislative branches of the state, non-employees, and volunteers or board/commission members when the member is not paid on state payroll are not required to use the OAKS FIN Travel and Expenses Module. When travel reimbursement is requested outside the OAKS FIN Travel and Expenses Module, the traveler must complete Travel Reimbursement Invoice (OBM-1115).

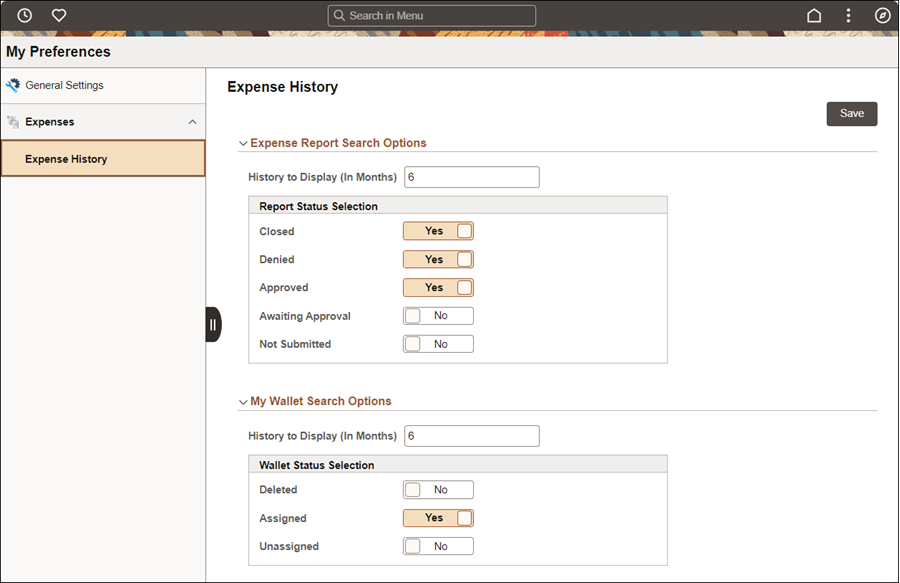

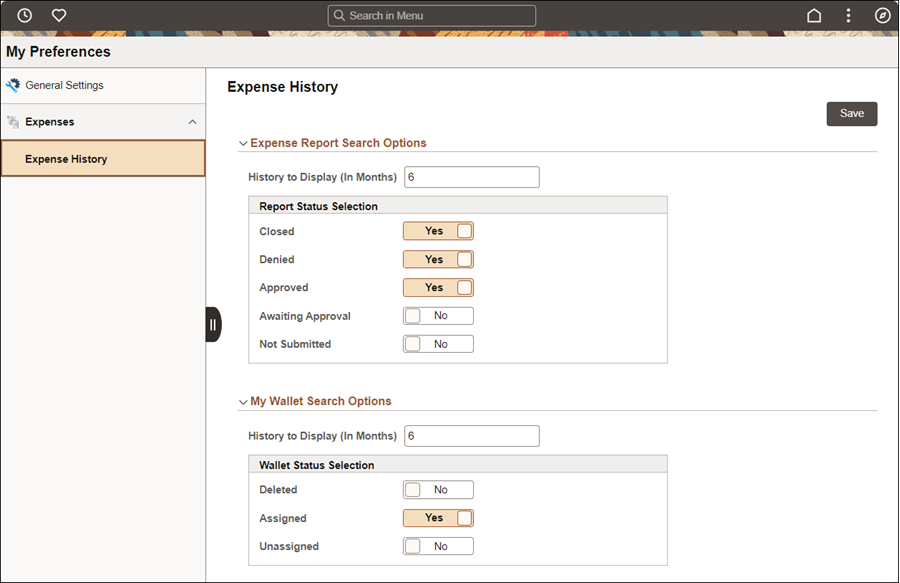

For traveler's to view their Expense Report history, they must change their expense preferences. Perform the following steps:

All employees of state agencies, departments, boards and commissions are required to request travel reimbursements through the OAKS FIN Travel and Expenses Module. OBM Financial Shared Services (FSS) reviews travel expenses submitted through the OAKS FIN Travel and Expenses Module prior to reimbursement to verify compliance and ensure reimbursement requests align with expenses incurred.

OAC 126-1-02 (OBM Travel Rule) establishes the rates and requirements for reimbursement of travel expenses of state agents. A "state agent" is defined within the rule as any officer, member, or employee of a state agency whose compensation is paid, in whole or in part, from state funds but does not include any volunteer serving without compensation.

For the purposes of this guidance, a "traveler" is a "state agent" traveling at state expense or on paid travel status for which is authorized by the head of a state agency or his/her designee.

The travel process has the following main steps:

Traveler creates a Travel Authorization (TA) when they will be reimbursed for lodging, international travel, car rental, or airfare. If the travel is mileage only, no travel authorization is required (or authorized).

When being reimbursed for lodging, international travel, car rental, and airfare, prior to travel, the traveler creates a travel authorization in the Travel and Expense application of OAKS FIN.

The Travel Authorization contains an estimate of all anticipated expenses the traveler will incur. Estimates should strive to be as accurate and complete as possible.

A Travel Authorization represents pre-approval for planned travel based on estimated expenses as required by the OBM Travel Rule.

By requiring travelers to accurately estimate their costs prior to travel, the state can accurately budget for future travel costs and correct any budget issues that exist.

A traveler must obtain supervisor approval for travel even if it does not require a Travel Authorization.

Refer to the Travel Authorization Overview topic for more information on creating a travel authorization (Travelers).

Supervisor Reviews and Approves, Sends Back, or Denies Travel Authorization.

The traveler’s supervisor reviews the travel authorization and determines whether to approve the travel. Supervisors may approve, send back for revision, or deny travel authorizations.

Supervisors approve Travel Authorizations when there is a legitimate business reason for the travel and when the traveler makes economical and efficient travel arrangements.

After approval, OAKS creates a budget encumbrance for the travel.

Supervisors send back Travel Authorizations for revision if corrections are required.

For example, supervisor feels an anticipated expense is unnecessary or inaccurately estimated.

Refer to the Approving or Denying Travel Authorizations topic for more information on approving travel (Supervisors).

Traveler completes travel as detailed in the Travel Authorization and submits a travel Expense Report (ER).

Refer to Creating Travel Expense Reports.

Once travel is complete, traveler creates an Expense Report (ER) with required receipts.

Travelers create expense reports from an approved Travel Authorization if the traveler is being reimbursed for lodging, international travel, car rental, or airfare.

If reimbursement request does not include one of the above expense types, the expenses are entered directly into an expense report.

A state agent shall submit the travel Expense Reimbursement request within sixty days of the last date of travel. This time frame may be extended by the head of the state agency or his/her designee if mitigating circumstances exist, but in no case may this time frame exceed ninety days from the last date of travel (unless the terms of an applicable collectively bargained agreement differs) [OBM Travel Rule 126-1-02(B)(2)(a)].

Expense Reports not created from Travel Authorizations route to supervisor for approval.

Multiple expense reports are not allowed for one Travel Authorization.

OBM Financial Shared Services (FSS) Reviews Travel Expense Reports to ensure compliance to the OBM Travel Rule.

Expense reports that do not require supervisor approval will enter the review process directly.

If an Expense Report exceeds 20% of the travel authorization estimate, it must be approved by the traveler's supervisor before it enters the review process.

OBM Financial Shared Services (FSS) verifies compliance with the OBM Travel Rule and ensure that requested reimbursements align with actual allowable expenses incurred.

Automatic approval of travel Expense Reports occurs when the report only contains mileage reimbursements under $100.00.

All other travel expenses require review and approval.

OSS may send back or deny Expense Reports that are not compliant with the OBM Travel Rule.

OSS sends back Expense Reports if modifications are required. (Example: reimbursement request greater than amount on receipt).

OSS denies Expense Reports if repeatedly and/or grossly in violation of OBM Travel Rule.

Travelers receive an email when OSS approves or denies their Expense Report.

Reimbursements for approved travel expenses generally appear in the traveler’s bank account (via direct deposit) within 7 days after passing reviewer approval.

Once approved by OSS, Expense Reports are held for review of coding for five days then enter the payment process.

An automatic email notifies the traveler when payment processes begins.

Travelers expense reimbursements deposit to traveler's bank account within 2 business days of payment processing notification.

Payments deposit to bank account used for payroll deposit (no exceptions).

Travelers can verify status of reimbursements in OAKS FIN Travel and Expense module.