Revised: 10/07/2024

Expense Reports are required for all travel expenses. However, Travel Authorizations are only required when reimbursement includes claims for lodging, airfare, car rental, or international travel.

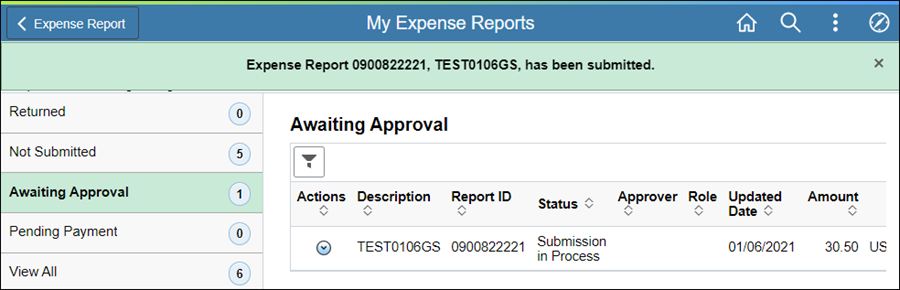

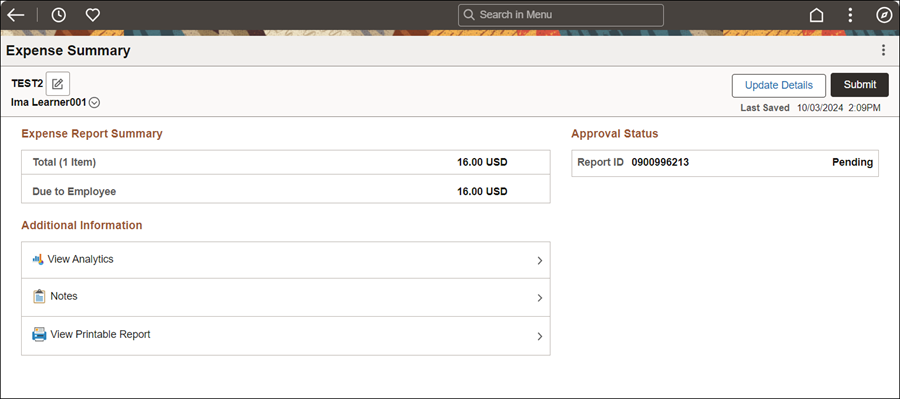

For travel expenses that do not require a Travel Authorization, the traveler creates an Expense Report for actual costs incurred once travel is complete. The Expense Report is routed to a Supervisor for review and approval before being sent to OBM Financial Shared Services (FSS). OSS Reviews the Expense Report to ensure compliance to the OBM Travel Rule.

Travel Expense Reports shall indicate all intermediate destinations (i.e., specify intermediate towns and cities but not stops within a town or city) between the commencement and termination of travel as well as all vicinity mileage after arrival at destination. Reimbursement shall be made to only one of two or more state agents traveling in the same privately-owned automobile.

Vicinity Mileage must be documented on separate lines within the ER when the vicinity mileage, if searched online (map quest, google maps, etc.), is greater than 10% of the total mileage being claimed.

Intermediate Destinations are same-day, business-related stops between the originating and destination locations. Travel Expense Reports shall indicate all intermediate destinations (i.e., specify intermediate towns and cities but not stops within a town or city) between the commencement and termination of travel.

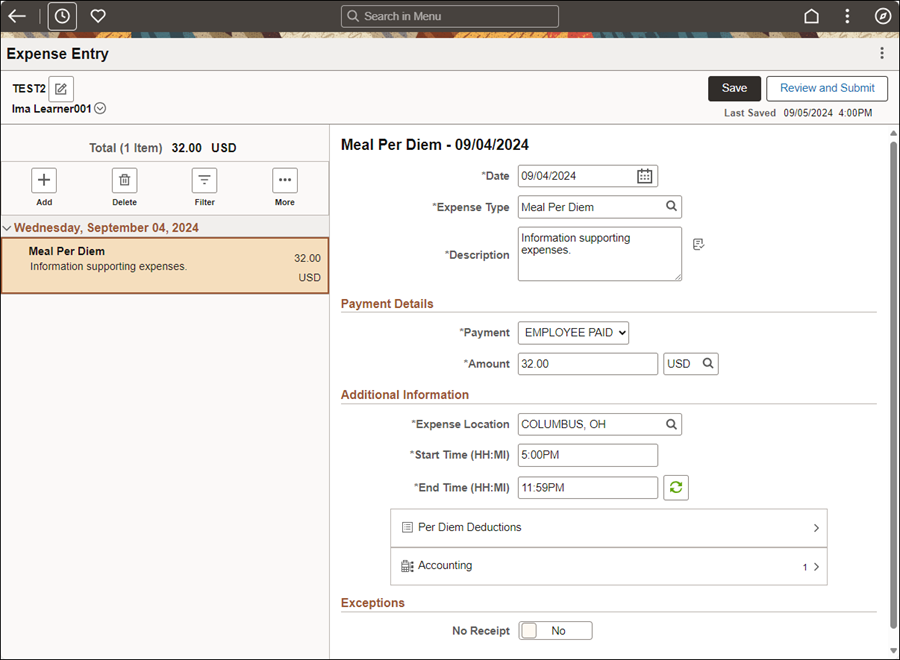

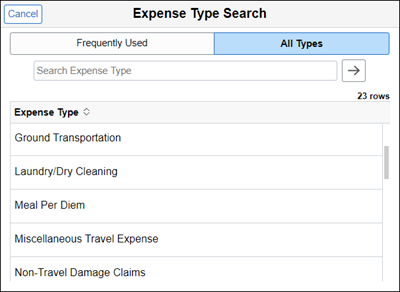

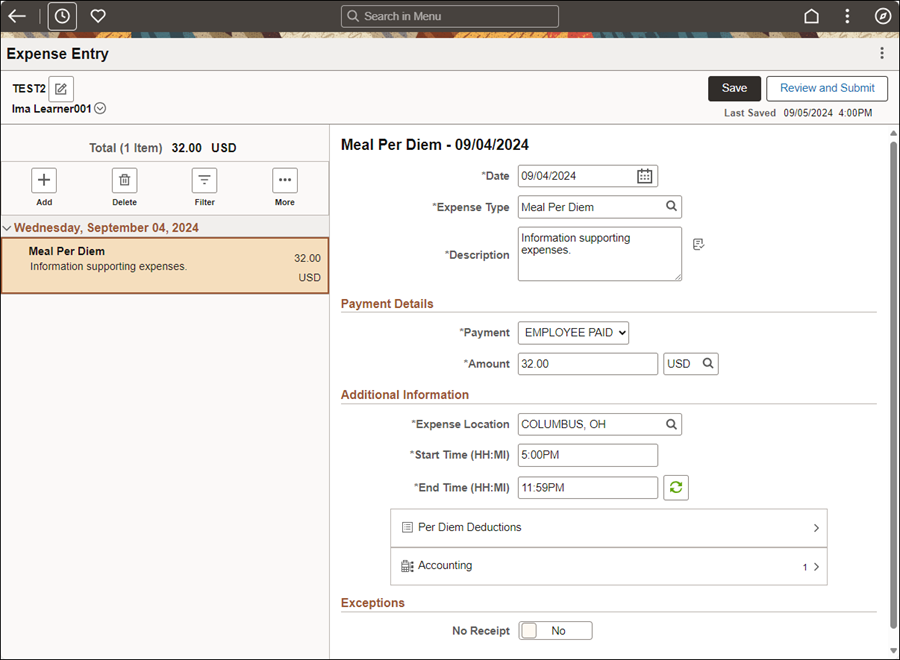

Expense Reports must document only actual and allowed expenses incurred while traveling and must be itemized to reflect the actual dates of travel.

It is important to verify that the expense dates and amounts on the expense report exactly match the dates and amounts shown on the required receipts. If ER dates and amounts do not match the receipts the expense report will be returned for revision.

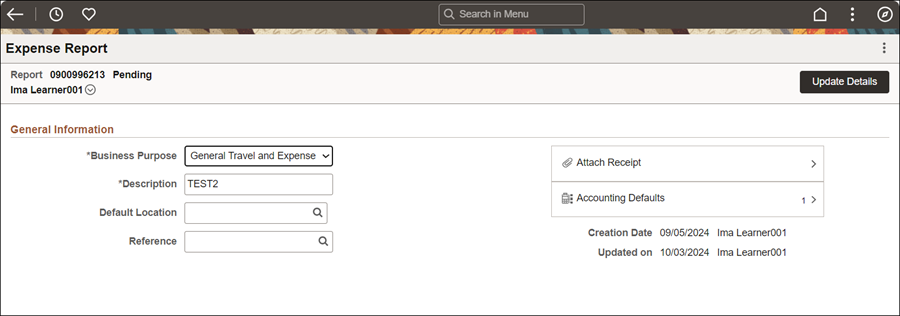

Click the Attach Receipt to add relevant files.

See Receipt RequirementsReceipt Requirements.

Receipts and backup documentation for travel and expense report reimbursement requests must be attached to the expense report.

Enter Comments / Notes providing justification for the following exceptions:

When dates on the Travel Authorization do not align with the dates on the Expense Report.

When claiming reimbursement for Meal Per Diems and lodging was State prepaid.

When reimbursement information on the Expense Report does not match receipts provided (name, location, charges).

When Per Diem does not align with hotel location, intermediate destinations, and / or vicinity mileage.