Revised: 10/07/2024

Reviewing ISTV Viewer Page

Overview

The ISTV Viewer Page enables accounts receivable and accounts payable agency staff to view and track invoice status through the entire ISTV cycle. This page is used to search for a specific record in OAKS FIN. Search criteria is entered in order to pull up the specific record between the selling agency and the buying agency. Once a specific record is found, the Account Receivable tab provides information about the bill or item. The Accounts Payable tab provides information about the invoice.

Steps

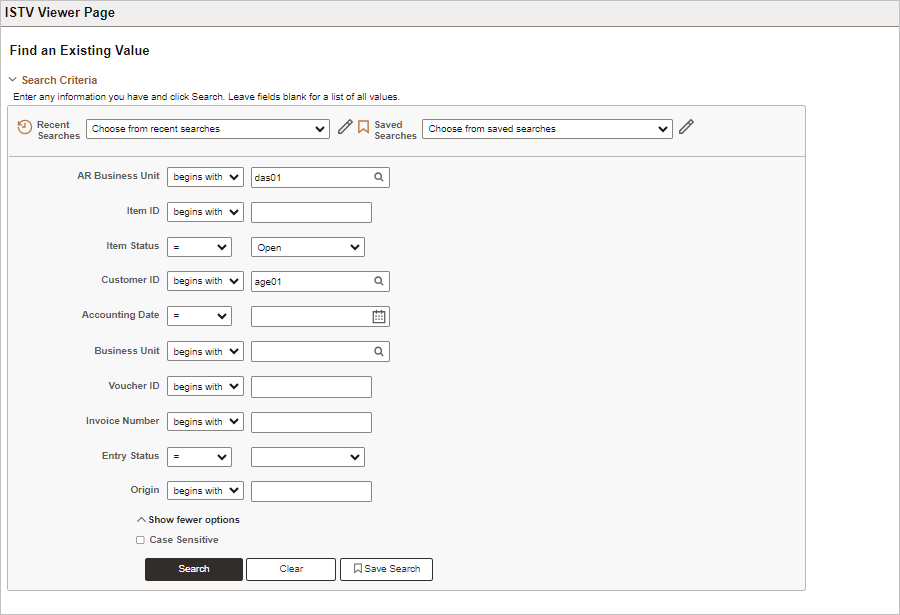

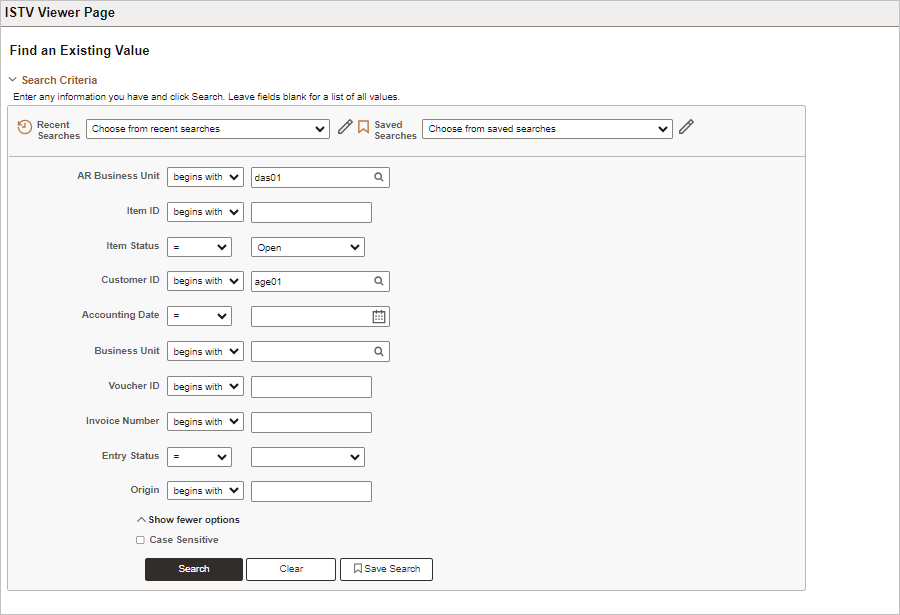

- Using at least two of the first five search criteria will retrieve information on the Accounts Receivable side.

- Using at least two of the last five search criteria will retrieve information related to Accounts Payable.

- Enter the

AR Business Unit

code for the selling agency.

- Choose the Item Status to narrow the search.

- Enter the buying agency code in the Customer ID field.

- Other parameters can be entered, but using the three fields above will show a list of all open (or closed) invoices and vouchers between the two state agencies.

- Click

Search.

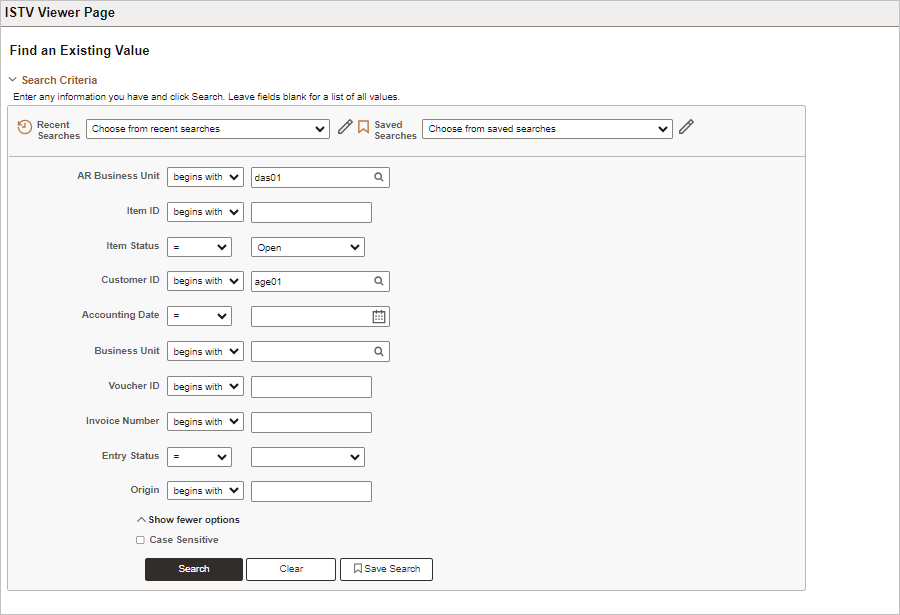

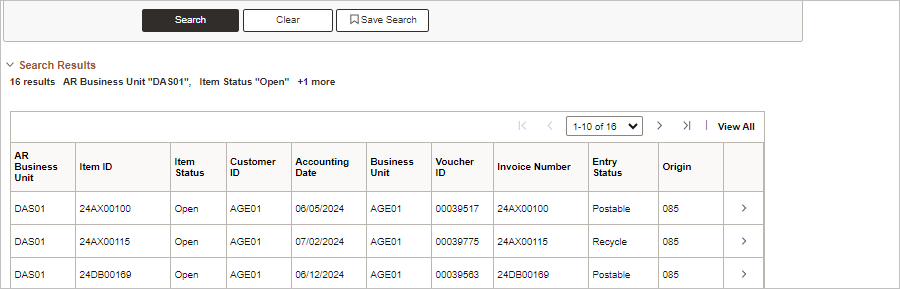

- A list of results will appear in the

Search Results

area.

- Click on an

Item ID

to review information.

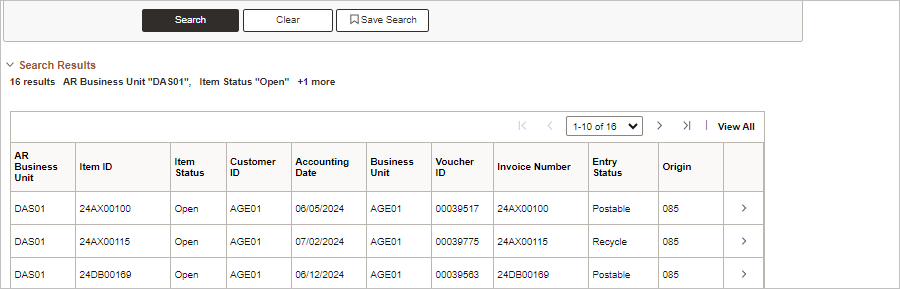

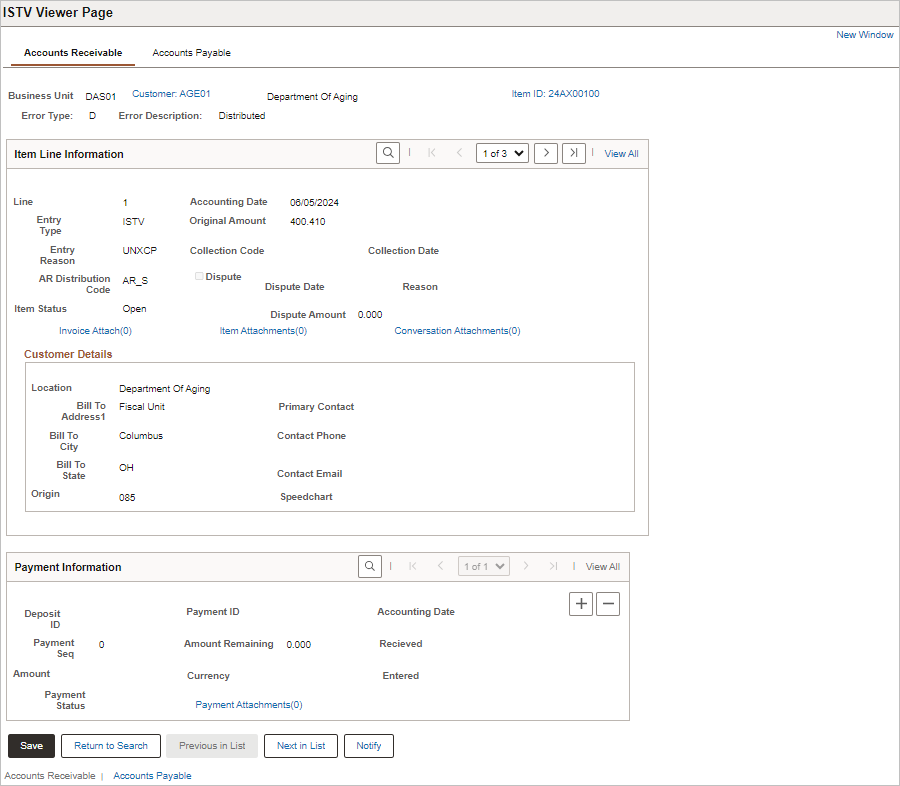

- Click the

Accounts Receivable

tab to open and view the attached invoice.

- Click the

Accounts Payable

tab for information about the voucher (e.g., the Approval Status).

- If an attachment was not uploaded before the item was processed, it can be added later in Customer Conversations and still be accessed through the ISTV Viewer Page.

- Looking at both the AR and

AP sides will help determine if there is an issue with an invoice or voucher.

- There could be situations where a problem arises between the selling agency and the buying agency, such as:

-

- The buying agency will deny the voucher (Accounts Payable), when an improper invoice is received.

- An incorrect AP origin code was added to a customer address location and the voucher was incorrectly routed.

- A payment is delayed or late.

- The selling agency will dispute the bill (Accounts Receivable).

- Agencies do not delete ISTV vouchers. Review Deleting ISTV Vouchers for guidelines for submitting a request to OBM State Accounting for deletion.

Late or Past Due Payments

Both the selling and buying agencies view the payment status of bills and track if a payment is getting close to being past due. A few proactive steps can be taken by the agencies to help:

- Before filing disputes, buying and selling agencies communicate with one another and review the status of vouchers on the ISTV Viewer Page.

- Selling agencies review age receivables reports regularly to confirm payment within the 30 day payment window.

If the payment is past due, then the selling agency contacts the buying agency to communicate the issue. It could be resolved quickly and no additional steps are required.

Dispute

If, after the two agencies communicate, there is still a conflict or payment is not received in a timely fashion, then the selling agency should go into OAKS FIN and “flag” the delinquent payment when it is 30 days past due. Refer to Placing Items in Dispute and Resolving Disputed Items.

By flagging payments, OAKS FIN will generate a report for the Ohio Office of Budget and Management (OBM) indicating which payments are delinquent and are in dispute or denied. OBM will only act as the collector, 30 days after the payment due date based on the Ohio Revised Code (ORC) 131.34.

The ISTV Viewer Page will be a key to determining the status of an invoice / voucher, and see if an item has been “flagged”

Dispute

.